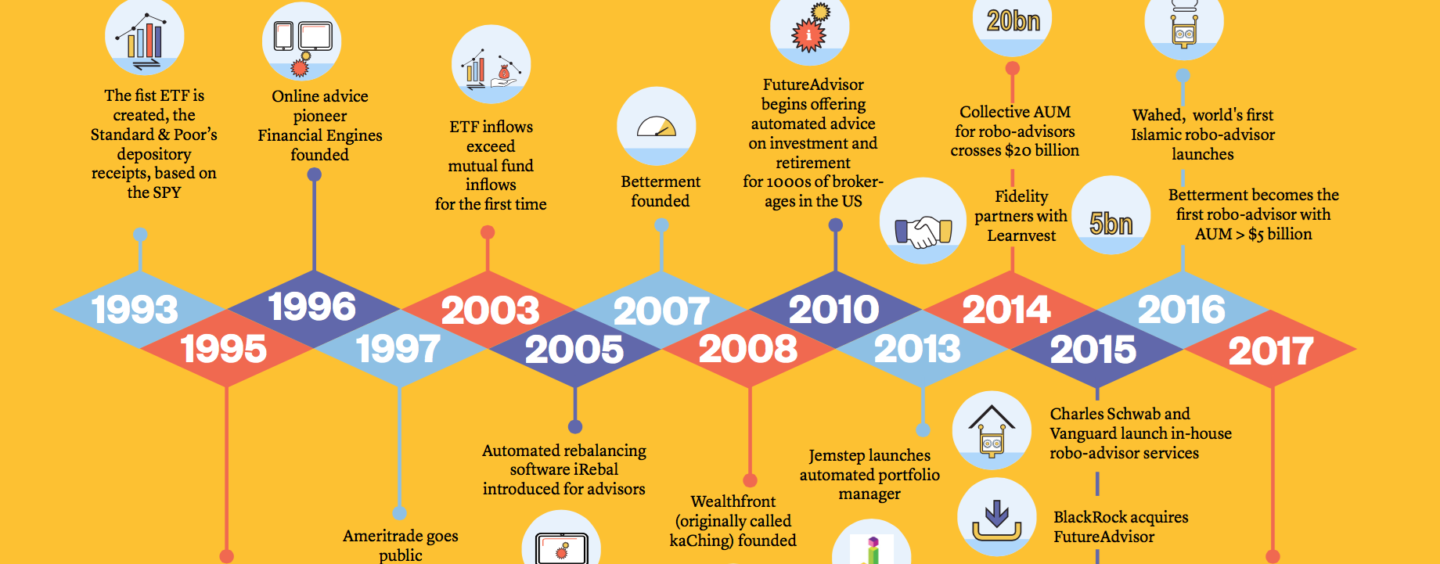

An April 2017 Burnmark report rexplored the tie-up between digital wealth and robo-advisory within the FinTech industry.

With retail investors demanding for more complex asset classes and investments and increased transparency and control over investments, traditional wealth management firms, more wealth manage firms are joining the digital space and as a result, introducing automated wealth management tools called robo-advisors. Robo-advisory is also growing rapidly especially in exchange-traded fund platforms, said the Burnmark report.

Image via Burnmark Report

Huge market potential for digital wealth

A record figure of assets is being transferred inter-generationally from the baby boomers to the current generation. Over the next 30 to 40 years, an additional an additional US$30 trillion in financial and non-financial assets will pass from boomers to their heirs in North America alone. The millennial generation, with 80 million investors, is now the largest generational client base of digital wealth management in the US, said the report.

They exhibit very different investment behavior with 64 percent of high net worth clients under 40 years old expect to access their accounts via a website and 54 percent expect to use digital channels such as mobile applications, social media or video. With their gender-specific investment needs, more women are also investing in digital wealth products.

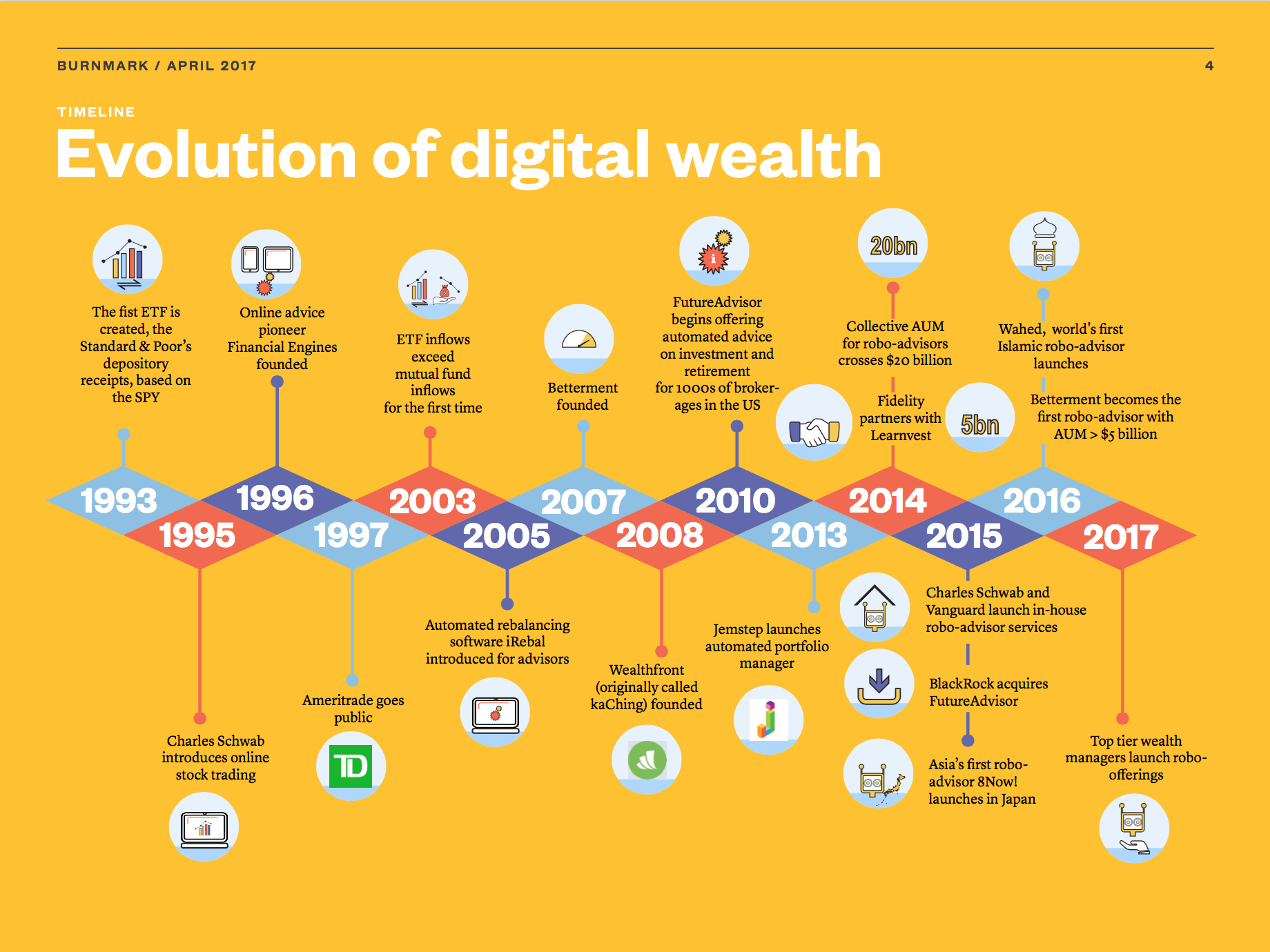

Countries such as China, India, Russia and South Africa have large segments of millennial investors who are also keen to try digital advisory platforms. These niche markets do need micro-personalized products and services, while still being delivered cost-effectively, noted the report.

Image via Burnmark Report

Robo-advisory models in the world

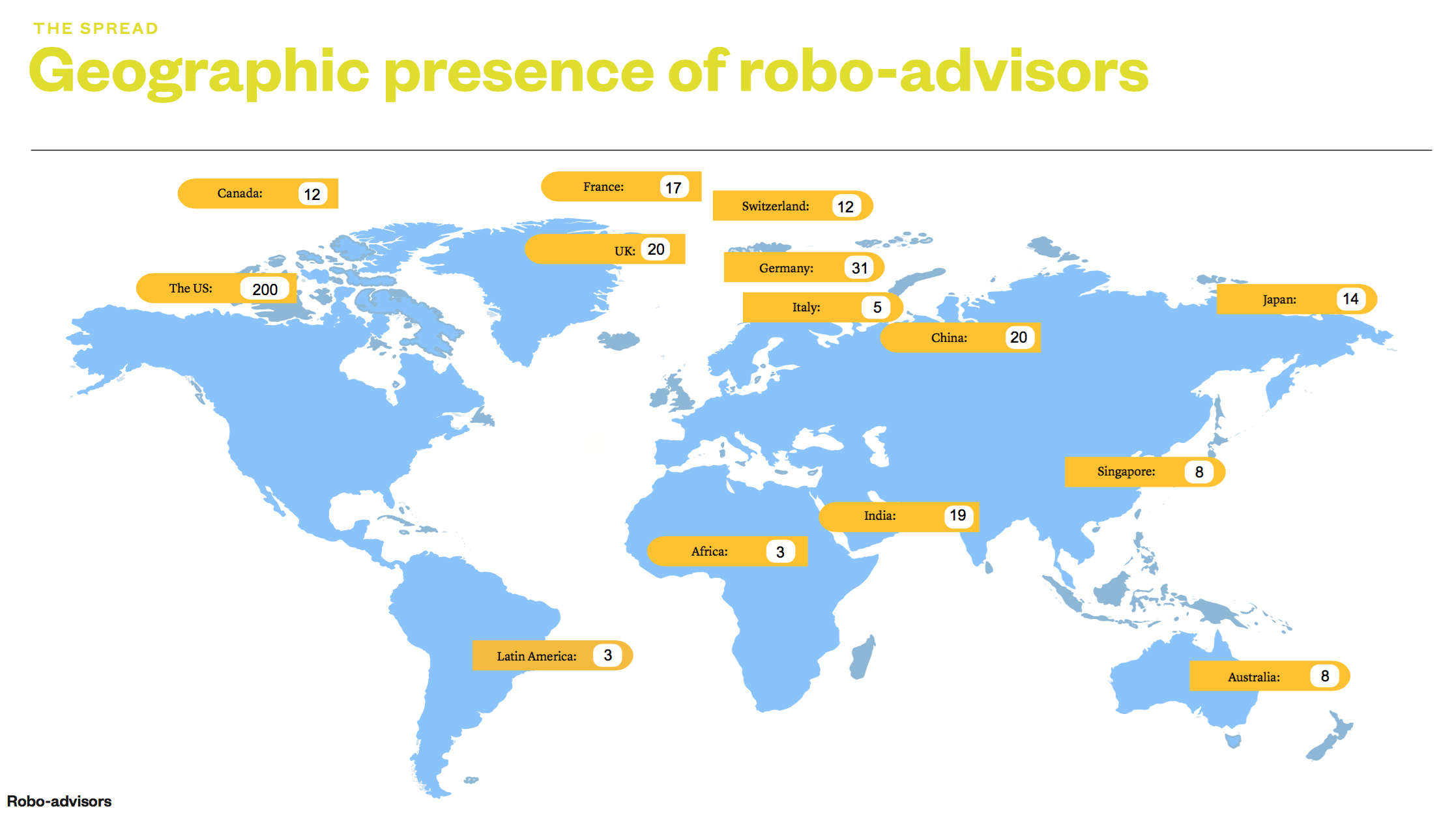

A common form of robo-advisory is the direct-to-consumer (D2C) robo-advisors. with limited advisor assistance. These are online platforms that provide automated, algorithm-based portfolio management and without intervention from human advisors. Business-to-business (B2B) advisory comprises white-label digital platform solution providers for traditional advisors enabling them to offer their own digital wealth management solutions.

There is also the hybrid advisory, which are traditional advisory services, including personalised conversations and actively managed portfolios blended with computerized portfolio recommendations.

The US is the hub of D2C robo-advisors with two clear leaders, Betterment and Wealthfront, with assets under management of US$7.3 billion and US$5.1 billion respectively. Meanwhile, Bambu operates as a B2B robo-advisor in Asia, and within two months of launch has secured partnerships with Thomson Reuters, Tigerspike, Finantix, and Eigencat. Infinity Partners and Smartly aim to launch soon as the first platforms in Singapore, along with the new entrant women-focused robo-advisor, Miss Kaya.

Challenges in meeting customer experience and expectations

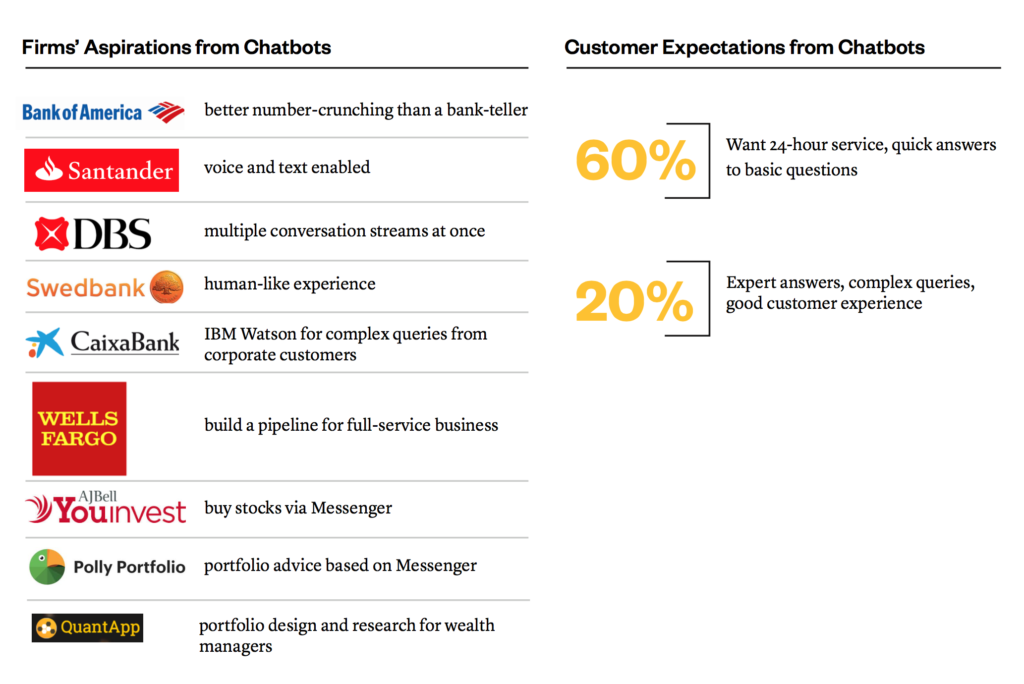

Burnmark highlighted the use of chatbots, which are artificial intelligence tools that provide intuitive answers in to generic customer questions. For digital wealth management, chatbots can respond to standard customer queries and provide automated advice via text, freeing up relationship managers to focus on complex requests and products.

But according to a recent survey, customers are frustrated with digital customer services offered, with 40 percent experiencing delays in getting answers to simple questions in the last month and 33 percent suffering from poor quality or unresponsive contact facilities. This frustration is the primary driver for more than 70 percent of customers being willing to accept robo advice for their investments

But according to a recent survey, customers are frustrated with digital customer services offered, with 40 percent experiencing delays in getting answers to simple questions in the last month and 33 percent suffering from poor quality or unresponsive contact facilities. This frustration is the primary driver for more than 70 percent of customers being willing to accept robo advice for their investments

Burnmark found that chatbots are a necessity for strong customer service and can be useful in expanding the client base towards lower net worths. Existing customers in wealth management expect the convenience afforded by chatbots, and the upcoming generations see it as a matter of course. However, these younger clients also rely on their wealth manager for life goal planning, a function that currently does not work well with chatbots.

Future trends

Online brokers are sensing the opportunity offered by the millennial investors. Several online brokers have launched their own robo-advisory offerings as an additional service for the retail investors. For instance, TD Ameritrade, which manages assets of over US$28 billion, has launched a new robo-advisory platform called Essential Portfolios.

The democratisation of wealth services, combined with greater wealth accumulation, will mean that every type of provider will have a bigger range of potential customers.

The key to the future of robo-advisory, as with all spaces within FinTech, will be the degree of personalisation offered for education (and generating interest in investing) as well as investment management (based on life goals and interests). Thus niche segments will emerge, and technology will act as the super layer eliminating the border between desire and advice.

Chatbots, who are seeing tremendous early stage capital today, will develop significant vocabulary within the space. And new markets will emerge in developing countries with their increasing middle class population and interest in investing from rural population through mobile devices.