Asia’s First Robo-Advisor Mobile App Chloe To Launch in Hong Kong

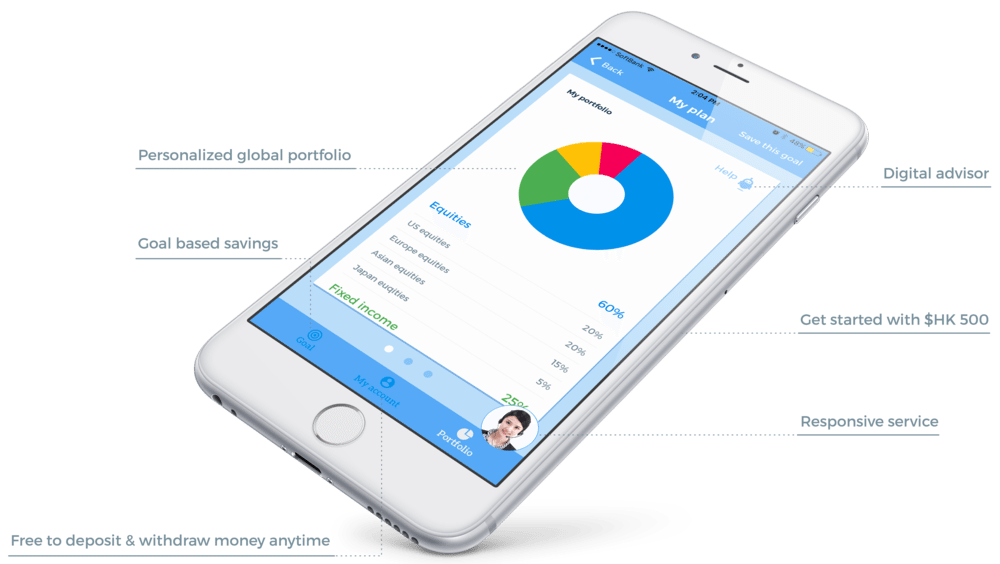

by Fintech News Hong Kong August 1, 20168 Securities, a leading fintech firm in Asia, today announced the upcoming launch of Asia’s first robo-advisor mobile app Chloe in Hong Kong. The minimum investment amount with Chloe will be under HK$1,000. In addition, customers will have the freedom to deposit or withdraw money from their portfolio anytime and with no penalty at all.

The app helps users set financial goals based on their life stage and income, and help them achieve their goals. Powered by artificial intelligence (AI) and machine learning technologies developed in-house, Chloe will learn day by day as its user base and database grow to optimize goal-setting and portfolio matching for customers with different financial needs.

At the heart of Chloe, the proprietary cloud technology built on Microsoft and Amazon Web Services intelligently optimizes the construction and periodical readjustment of a selected exchange traded funds (ETFs) portfolio. The disruptive technology developed by 8 Securities makes it possible for investors to enjoy a customized and globally diversified portfolio at a fraction of the cost charged by banks and brokerages.

Last month, 8 Securities was named Geek Park’s “Top 50 Most Valuable Startups” at the Innovators Summit in Shanghai, selected by top venture capital firms including Sequoia, IDG and GGV.

There were 4 million new companies started in China last year alone, and this recognition is a testament to 8 Securities’ leadership in developing and providing cutting edge financial technology. In the same month, the firm’s CEO Mikaal Abdulla has made to FintechAsia’s “Top 38 Fintech Influencers in Asia” list.

Mathias Helleu, Executive Chairman and co-founder of 8 Securities, said: “Technology has in many ways already changed how we live, and it is bound to be the next wave of disruption sweeping through Asia’s wealth management industry. Our vision is to democratize global investing for individuals across Asia, and we are using technology to make growing money simpler, more transparent and affordable.

We believe everyone deserves the same access to world-class investing as the big guys. Chloe answers to the growing demand of investors whose needs are not met by traditional financial services today, providing them with a fully-digitalized alternative to expensive advisory services and potential cross-selling of unnecessary products that still exists at most banks.”

Chloe is the second generation robo-advisor developed by 8 Securities, which has introduced Asia’s first intelligently optimized investment service into Hong Kong and Japan since two years ago.

Chloe will ask each new customer a few questions to predict the most important investment goals based on his/her life stage and income. Once the savings goals, target date, initial endowment and suitability are determined, the customer will be presented a personalized portfolio of up to 10 ETFs. Below set out other key features of Chloe:

– Revolutionary low pricing. With no transaction fee or any hidden charges, customers will pay only one fee that is at a fraction of costs charged by traditional advisors. The exact fee details will be announced at the official launch of Chloe.

– Simple. The globally diversified portfolios will be monitored and readjusted based on changing market conditions at no additional cost. The portfolios will be available in HKD.

– Transparent. Users can monitor the performance of their portfolio 24 hours a day, 7

days a week via their PC or mobile device.

– Affordable. The minimum investment amount with Chloe will be under HK$1,000.

Cedric Roll, Chief Technology Officer of 8 Securities, said: “Chloe is fully aware of human nature, be it irrationality, cognitive bias or fears, and how this sometimes conflicts with investors’ best interests in the capital markets. She is a goal-based advisor who will persistently help customers to achieve the set savings goals – ranging from buying a holiday package, making a down payment for an apartment, paying for a child’s education to planning for retirement – without unnecessary distractions.

We believe an affordable savings plan and fully digitalized customer experience will be the future for retail investments, and the players who can move quickly enough to embrace this will write the history for wealth management 2.0.”

Asia is still behind the game in offering robo-advice, which is currently an over US$100 billion market globally. For instance, assets held by robo-advisors in Hong Kong are expected to expand exponentially from US$400 million in 2016 to US$20.6 billion in 2020, according to Aite Group’s latest robo-advisor forecast.

From now until August 2016, Chloe will admit interested parties to its waitlist at https://www.8securities.com/. After the official launch of Chloe, prospective users will be able to try the robo-advisory service before they open an account.

Chloe will be available on iOS, and Android app stores in the third quarter of 2016.

This article first appeared on Fintech News Singapore