First Industry-Wide Use of Blockchain-Based Authentication in Motor Insurance

by Company Announcement December 18, 2018CryptoBLK in collaboration with The Hong Kong Federation of Insurance (HKFI), launched a Motor Insurance DLT-based Authentication System (MIDAS), the first motor insurance platform in Asia using blockchain technology in production to verify the authenticity of motor cover notes/policies.

Verification of motor insurance documents has been a challenge due to fake documents from illegal motor insurance brokers. There was also the added difficulty in tracking multiple fraudulent claims over a single incident.

Transport Department Office Authenticates Data on MIDAS

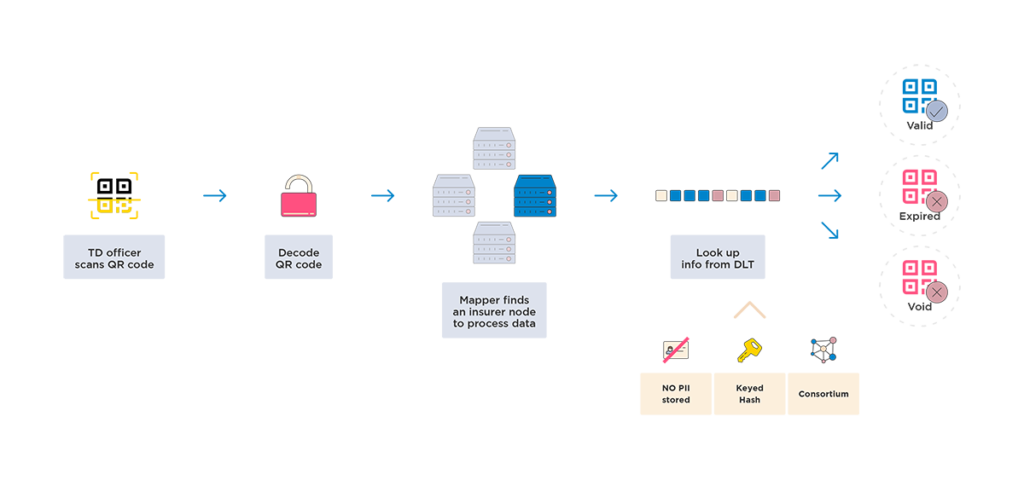

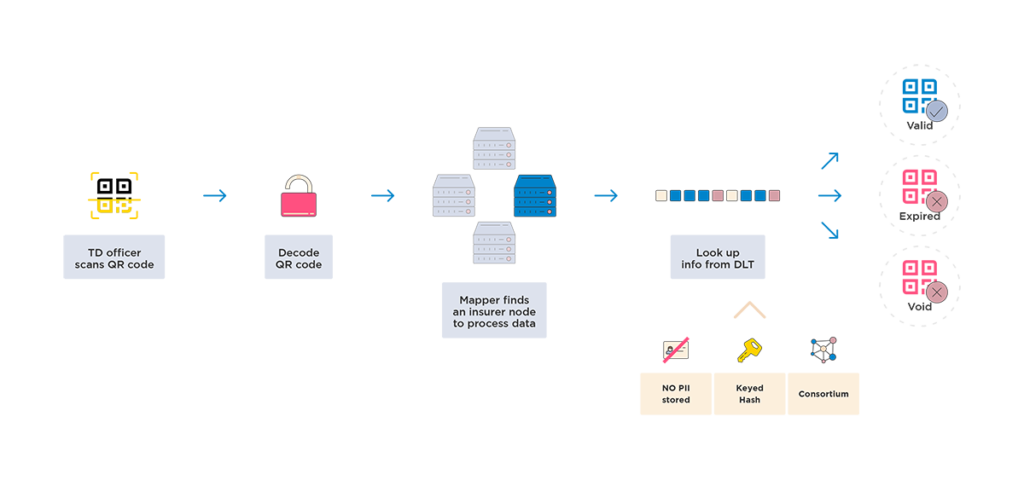

With MIDAS, the underlying blockchain technology, or DLT (distributed ledger technology), now offers real-time authentication of motor insurance notes and policies, as well as multi-stakeholder verification and audit trails. Furthermore, no Personal Identifiable Information (PII) including the vehicle owner’s name, ID, is stored on the MIDAS to protect the car owner’s privacy. MIDAS adds greater security and efficiency in motor insurance, and its launch represents a major milestone in the digitisation efforts of the insurance industry in Hong Kong.

How Insurance Company Accesses to MIDAS

Car owners can now use specific QR codes generated by MIDAS and have their motor insurance cover notes/policies authenticated at all of four Licensing Offices of Transport Department.

Dr Duncan Wong, CEO and Co-founder of CryptoBLK (left) and Mr Peter Tam, Chief Executive of The Hong Kong Federation of Insurers, were delighted to see CryptoBLK’s disruptive DLT-based solution adopted by the insurance and the public sector.

Dr. Duncan Wong, CEO and Co-founder of CryptoBLK, said,

“CryptoBLK is focused on developing next-generation DLTplatforms that can revolutionise fintech through DLT and cryptography, and we’re excited to see the official launch of Hong Kong’s new motor insurance authentication platform. MIDAS is an excellent example for demonstrating how DLT can be a catalyst that accelerates an industry-wide digital transformation movement. CryptoBLK is thrilled to play a major role in evolving the insurance industry standards in Hong Kong, fostering real business innovations through applying innovative technologies, while contributing to the betterment of the public and society.”

The MIDAS platform took 12 months to be developed, from concept design, testing and modifications, to the pilot runs and launch. The system has also passed independent cyber security audits. MIDAS has the following features which enable authentication, and at the same time, ensure data security and privacy:

- Blockchain Technology / Distributed Ledger Technology (DLT) – MIDAS has an audit trail for every single record created, and these records are stored on the underlying DLT system in an immutable format, to provide a single source of authentication;

- Privacy Protection – Only the minimum information required for authenticating a motor insurance document is recorded, and no PII is stored on the DLT system;

- Data Security – MIDAS follows the industry standards of secure deployment and operations. An annual security audit is conducted for ensuring cyber-security practice up-to-date;

- Ease of use – QR codes generated by the MIDAS platform provide easy access for car owners and Transport Department to authenticate insurance documents instantly.

“MIDAS is the first ever industry-wide application of blockchain technology in the space of motor insurance in Asia,” said Mr Philip Kwan, Chairman of HKFI’s Accident Insurance Association. “This is a classic case of Public-Private Partnership initiative to address the perennial problem of fake cover notes in our insurance market”,

added Mr Kwan.

Mr Peter Mok, Head of Incubation and Acceleration Programmes of HKSTP, was pleased to see the launch of MIDAS which is another success case for technology commercialisation.

“CryptoBLK is an incubator under our Incu-Tech programme, and it is gratifying to see their disruptive DLT-based solution recognised and adopted by the insurance and the public sector in Hong Kong. We believe there will be even more opportunities to apply blockchain technology to fintech, as Hong Kong takes a leading role as an international financial centre. As the city’s largest innovation and technology incubator, HKSTP will continue to provide tailored support services for start-ups at various stages of their development across different technology areas.”