Virtual Banking

ZA Bank Gains Regulatory Nod to Offer U.S. Stock Trading in Hong Kong

Hong Kong’s ZA Bank has received regulatory clearance from the Securities and Futures Commission (SFC) to expand its services. This approval amends the bank’s existing license, allowing it to move beyond dealing in collective investment schemes. ZA Bank is set

Read MoreBank Saqu Launches in Indonesia as WeLab’s Second Digital Bank in Asia

Hong Kong’s WeLab, in collaboration with Astra Financial, has launched Bank Saqu in Indonesia, marking its second digital banking venture in Asia. This new digital banking platform, operated by PT Bank Jasa Jakarta (BJJ), a joint venture between the two

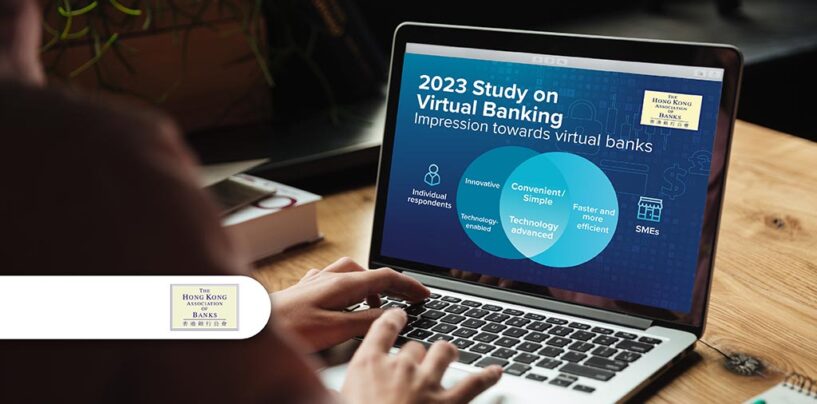

Read MoreOver 45% of Individuals and 76% of SMEs in Hong Kong Have Virtual Bank Accounts

Virtual banks in Hong Kong have gained significant popularity in recent years, with over 45% of individuals and 76% of SMEs surveyed by the Hong Kong Association of Banks (HKAB) having an account. The survey also found that 30% of

Read MoreZA Bank and Mox Bank Rank Among Top 10 Mobile Banking Apps in the World

ZA Bank and Mox Bank, two of the eight digital banks from Hong Kong, have ranked in the top 10 of Sia Partners’ 2023 Mobile Banking Benchmark, a global study of mobile banking apps. Sia ranked ZA Bank as 6th

Read MorePrivacy Commissioner’s Report Affirms ZA Bank’s Customer Data Protection Measures

The Office of the Privacy Commissioner for Personal Data (PCPD) has published an inspection report on the customers’ personal data system of ZA Bank, the first virtual bank in Hong Kong. ZA Bank was granted a virtual banking license by

Read MoreMox Bank Appoints Home-Grown Talent Edwin Hui as COO

Hong Kong’s virtual bank Mox announced that it has promoted Edwin Hui as its Chief Operating Officer (COO), effective 1 July 2023. Mox said that he is the first home-grown senior executive to make it on to the C-level team.

Read MoreMox Bags License to Roll Out Hong Kong and U.S. Equity Trading Services

Virtual bank Mox announced that it has obtained a Type 1 (dealing in securities) license from Hong Kong’s Securities and Futures Commission (SFC) to enable it to roll out Hong Kong and U.S. equity trading services. Mox will soon pilot

Read Morelivi bank and FWD Launches All-In-One Pet Insurance Offering

Hong Kong’s virtual bank livi has partnered with FWD General Insurance (FWDGI) to jointly launch a comprehensive pet insurance offering. Customers can easily apply for the Pet Care offering through the livi app. The insurance covers pet cats and dogs

Read MoreHigh Customer Costs a Drawback for Hong Kong’s Digital Banks Profitability

In the ever-evolving landscape of banking, even developed markets like Hong Kong face changing customer demands that traditional banks may struggle to meet. This has created an opportunity for digital banks to step in and offer highly personalized and digital

Read MoreZA Bank Plans to Offer Crypto Trading for Its Retail Investors

Hong Kong’s virtual bank ZA said that it plans to introduce virtual asset trading services for retail investors under the city’s new licensing regime announced yesterday. By partnering with Hong Kong-licensed virtual asset exchanges, ZA Bank aims to obtain the

Read More