Insurtech’s Explosion in Hong Kong, and What May Be Coming for the Scene

by Fintech News Hong Kong May 6, 2019Asia is traditionally a region with low insurance penetration, and Hong Kong was no exception to that rule.

Between 2012 – 2016, Hong Kong’s insurance penetration changed from 12.4% of the population to a 17.6% of the population—a significant increase considering, but definitely well below ideal insured rates.

This is partly because many Hong Kongers turn to the public healthcare system when their health fails, leading to overtax of the system. A primarily cash-based society didn’t help matters either.

Hong Kong had a Real Need for Insurtech

There’s always the biggest driver, like wanting to reduce the middlemen costs to have agents, banks and brokers and this is no small driver. In 2017, the health insurance premium to GDP ratio was 17.94 percent, the second-highest in Asia after Taiwan, partly because middlemen were so expensive in a region with such a high cost of living.

More than 80 percent of customers are willing to use digital methods including email, mobile apps, video or phone instead of interacting with insurers via agents or brokers, a report by consultancy EY shows.

Health-related wearables are in high demand among Hong Kong consumers too, with over 52% stating that they are likely or very likely to use wearable products during exercise.

As such, the market presents a prime opportunity for insurtech to thrive—and thrive it did, leading to a competitive market of various players growing increasingly more niche to gain footing.

Sorely Needed Digitisation for the Industry

Image Credit: Aviva

Some of the more popular insurtech players in the increasingly saturated market includes OneDegree, Bowtie, The CareVoice (which most recently launched a health chatbot)

OneDegree, founder Alvin Kwock through his mother’s cancer, saw the many inefficiencies of insurance in Hong Kong at the time, so left his cushy job at JP Morgan to take on the big job of digitising insurance.

Alvin Kwock

“Today’s insurance models are no different from how it was done 100 years ago, and one of the major reasons for this inertia is outdated technology systems.”

“We expect that 80% of claims will be settled within two days, as compared to weeks or months (under the old system).”

Their web-based insurance solution aims to offer user-friendly for purchases and management of insurance, via a robust backend system with analytics and automation of traditionally manual processes—like claims, policy management and customer service.

Now eyes are on incumbents using tech to advance their insurance game, like using big data to analyse risk and determine premiums. Such players include names like AIA (which launched a blockchain insurtech solution), MetLife, Manulife, and arguably, Tencent-owned Blue that is partly owned by British insurer Aviva.

Why Eyes are on Insurtech

Often, people hype up insurtech as a marker for financial inclusion and digital advancement of a region, but what does that actually entail?

Well for one thing, insurtech, like everything else tech these days, is all a data game.

Just throughout the insurance value chain, big data can help to indentify cost reduction opportunities, and bring together traditionally separate data sources, which helps to generate reports more quickly and at lower costs than before. These reports would naturally lead to development of more products and services the people actually need.

More relevant to the average joe is that big data can help insurers, both tech younglings and incumbents, to analyse consumer behaviour. The result could be better personalisation to customers, and build better relationships with them without requiring the massive fleet of agents traditionally.

The data, and relevant analytic tools could also help insurtechs with responsiveness to market shifts, perhaps with already having crucial insurance products ready for users right as the market shifts towards it. There’s also even more monetisation resources: you could sell that data as a form of revenue, rather than just as support.

These factors, partly, allowed for Hong Kong’s insurtechs to gain Hong Kong’s attention in their short existences.

Innovation, Not Competition with Incumbents

Image Credit: Bowtie

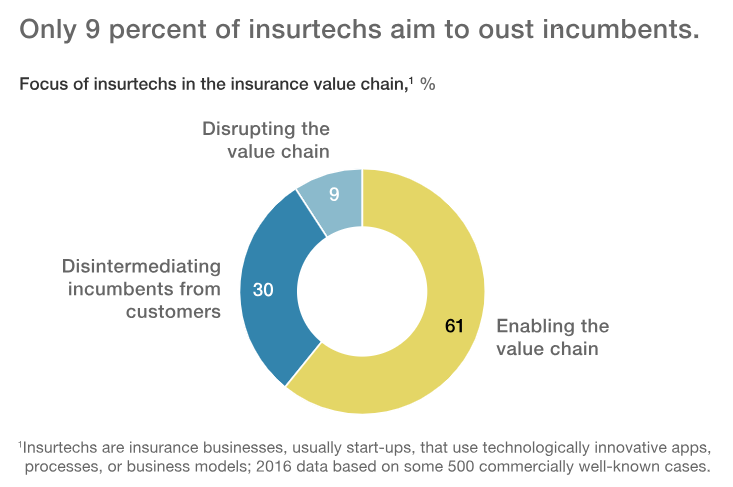

It’s natural for incumbents to feel wary of insurtechs coming into play, but often, they do not really look to disrupt, rather, innovate.

Bowtie’s Fred Ngan famously said that they do not plan to compete with traditional insurers.

“While they sell more sophisticated policies involving higher sums, we target simple life and medical products which don’t need much explanation and which enable the customers to buy and make claims all by themselves via their smart phones or computers.”

“We want to target a younger generation of customers who are tech savvy and like to do everything by themselves.”

This, incidentally, is also why insurtech is tapped to become one of the strong forces to help increase insured rates amongst average populations—they are able to hit markets otherwise difficult to tackle before.

While this is not a Hong Kong-based study, a 2017 article by McKinsey also showcased similar sentiments when it comes to insurtech.

Image Credit: McKinsey

Hence, we think traditional insurance incumbents in Hong Kong will look to partner with existing insurtechs. When one is already late to the game, it’s can be more strategic to partner with someone who knows what they’re doing instead of having to start an inferior version from scratch.

It is also prudent for insurtech players to partner with wother fintech players in the region, be they other insurtech players, or other but related platforms altogether.

More Specific Attention than Just Fintech

Insurance is an issue of financial inclusion, so the Hong Kong government via the Hong Kong Insurance Authority (IA) launched a fast track system in January—a sandbox to expedite the application authorisation of firms looking to engage digital-only insurance services.

Bowtie is Hong Kong’s first virtual insurer licensee, backed with US$30 million at the time of its licensing .

In fact, the founding of the IA itself is a marker of an increasingly robust insurance industry, as it only formed due to the unprecedented rate of Mainland Chinese buying into insurtech and policies in Hong Kong. Some observers seemingly call it the most significant regulatory reform to the industry in 20 years.

When hard times fall, insurance is sometimes the only thing stopping you from complete economic collapse, and invaluable when one needs to bounce back from related calamities or hardship. It is also worth noting that low insured populations are usually those of poorer communities, so when downfall hits them, it truly hits them worse than the well-to-dos. As a society, if that isn’t disturbing to consider then it should be.

Insurtech in Hong Kong is able to serve as an equalising force, serving the gaps that have been overlooked by previous versions of insurance. One can’t blame incumbents for this, as it’s not evil for a company to want to make money. And in a similar vein, one cannot begrudge the rising insurtechs for figuring this out and catering to the once maligned market.

Hong Kong’s insurtech scene while exciting, is still in its infancy, and it will be exciting to watch the space mature and develop in its own unique ways.