Japan’s Central Bank Explores a Central Bank Backed Digital Currency

by Fintech News Hong Kong March 1, 2019Perhaps in response to the call by IMF Chief Christine Largarde for nations to look into central bank backed digital currencies, Bank of Japan is now exploring the concept of central bank digital currency (CBDC).

Published this month by the bank, the working paper on “Digital Innovation, Data Revolution and Central Bank Digital Currency” examines how a CBDC would make or mar the country’s current financial system.

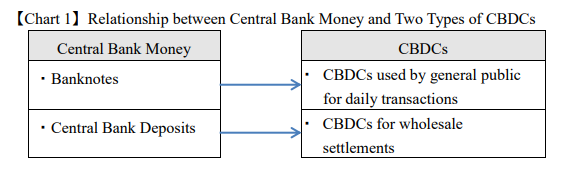

The paper has analysed two categories of CBDC – one, being used by general public for day-to-day transactions, and the other, for large-sum settlements based on central bank deposits and adoption of nascent technologies and innovations like distributed ledger technology (DLT).

An extract from the report said, “If CBDCs in the former category are issued through central bank accounts, the issuance of CBDCs will be similar to widening the access to central bank accounts also to ordinary people and operating central bank settlement systems on 24/7 basis.”

However, when CBDCs are used for daily transactions, it is prone to issues such as, the risk of crowding-out of bank deposits and squeezing banks’ financial intermediation, the report added.

Picture credits: BOJ report

There are certain factors that push Japan towards issuing a CBDC, the report said. Recent developments in new digital technologies and the evolving cashless payments add up to the thoughts behind issuing a central bank digital currency. Few other factors include improving the effectiveness of monetary policy and prevention of crime and AML due to CBDC’s anonymity.

How Would a Central Bank Backed Digital Currency be Issued?

BOJ has raised questions on issues surrounding a CBDC. In terms of issuing CBDC to general public, the report said that there are two options, one being direct issuance to people by the central bank, without any intermediary, and the other option is that central bank issuing CBDC to commercial banks and other intermediate entities that can in-turn provide digitized risk-free payment instruments to individuals.

The report continued,

“If the central bank issues CBDCs to general public, they can be “account-based”, in which the central bank allows ordinary people to directly access to its accounts, or “token-based”, in which each user can charge a certain amount of CBDCs to IC cards or smartphone APPs and transfer them to other users directly.”

There are other issues related to this as well, including anonymity of CBDCs and the technologies such as DLT, applied to CBDCs.

The working paper elaborates on commercial banks that are suffering from “shortage of liquidity”, which can be filled by central banks with a CBDC in order to prevent a harmful “bank run.”

What Are the Other Central Banks Doing?

Few other central banks in countries like China and Sweden have embarked on extensive research regarding issuing a central bank digital currency in the future. Sveriges Riksbank, the central bank of Sweden for example, issued two reports on its e-krona project. The central bank said that it will continue to deep dive into exploring various possibilities and risks involving e-krona.

Another country that is exploring to issue CBDC, after the country’s ban on cryptocurrencies and ICOs, is China. People’s Bank of China announced on January 2016 that it is looking to issue its CBDCs in future. The bank stated that CBDC will not only enhance efficiency and utility of payments and settlements, but also help in prevention of tax evasion.

What’s the Future of Central Bank Backed Digital Currencies?

Innovations in information technologies that are going beyond the horizons of money and payments, is one of the key factors behind increased interests in CBDCs today.

The latest report is balanced and details various use cases, types of CBDCs that can be considered and issues that might erupt with implementing a CBDC. At this time, it is highly speculative whether Bank of Japan is keen on issuing CBDCs.

That said, last October, BOJs deputy governor, Masayoshi Amamiya, stood strong on his negative stance towards central bank-issued digital currencies, claiming that these CBDCs are unlikely to improve the existing monetary systems, a Reuters report said.

Expressing doubts about the use of CBDCs, Amamiya claimed that these digital currencies are unlikely to improve the existing monetary systems. He put forward that the BOJ has no plan to issue digital currencies that can be widely used by the public for settlement and payment purposes.

“Getting rid of cash now is not an option for us as a central bank,” he added. “Crypto-assets are rarely used for day-to-day payment and settlement, and are mostly a target for speculative investment.”