Hong Kong, an international finance hub and technologically advanced center for logistics and communications, has been hard at work to develop a favorable environment for fintech innovation and startups.

As a result, the ecosystem has grown significantly in the past years, and today, the city is home to some of the world’s hottest fintech startups.

The following four infographics outline Hong Kong’s unique features as a fintech hub and showcase the city’s burgeoning fintech industry.

Hong Kong as a fintech hub

Hong Kong has got some key advantages when it comes to fintech. First off, the city is home to one of the world’s top financial centers and is widely renowned for its ease of doing business. Hong Kong also has the world’s freest market and one of world’s simplest tax systems.

Additionally, it is the number one market in Asia in terms of smartphone penetration and has one of the fastest growing startup ecosystems in the world.

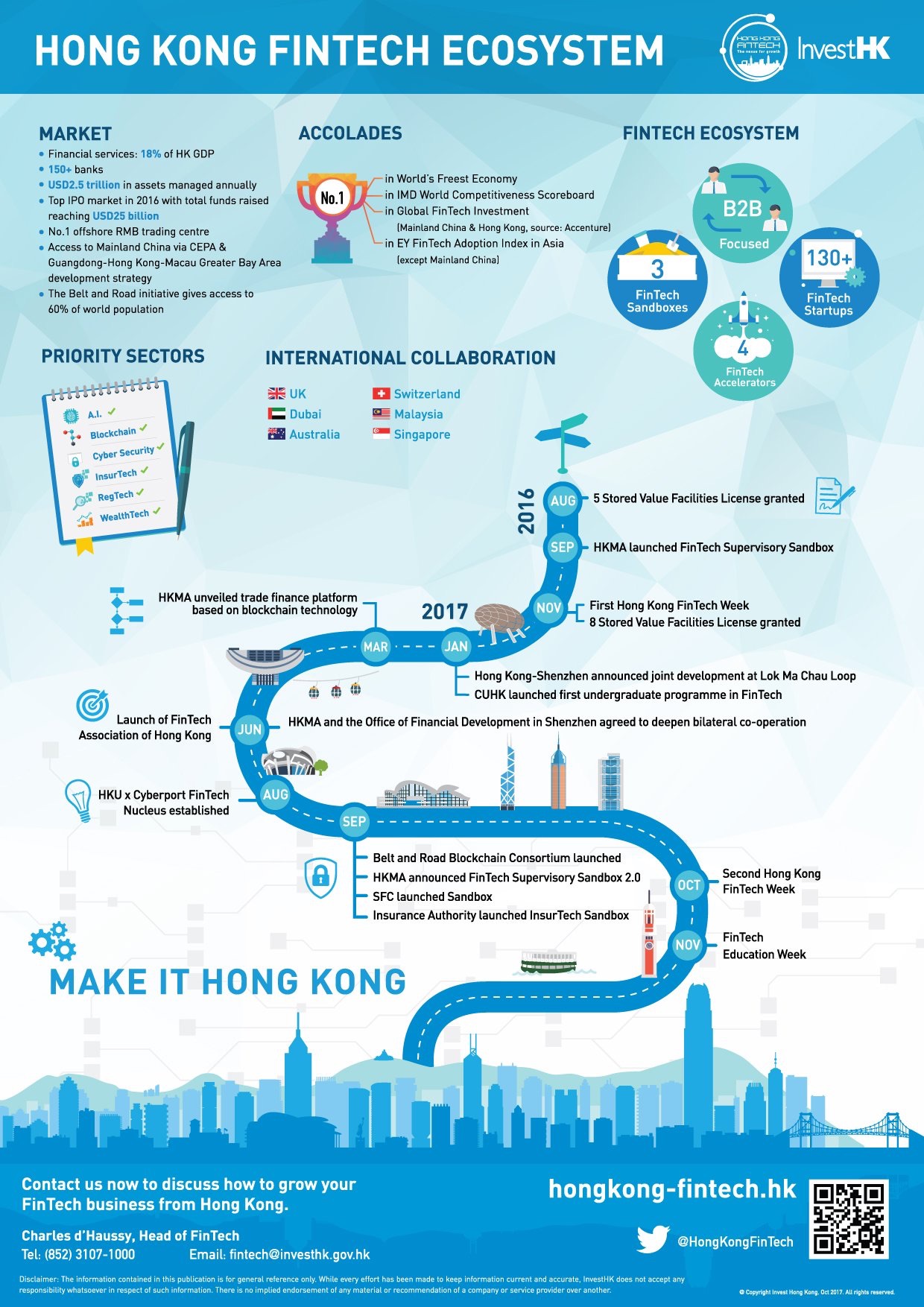

Hong Kong’s fintech ecosystem

In the past years, the government has launched several initiatives aimed at fostering collaboration between industry participants, facilitating innovation, and attracting young startups.

These include three regulatory sandboxes, the Hong Kong Fintech Week, which brings thousands of participants every year, educational programs, as well as regulations aimed at providing clarity to young, innovative startups.

Hong Kong has also inked partnerships with several other countries including Switzerland, Singapore, Australia, the UK and Dubai to strengthen co-operation on fintech and help its innovative companies expand more easily into these markets.

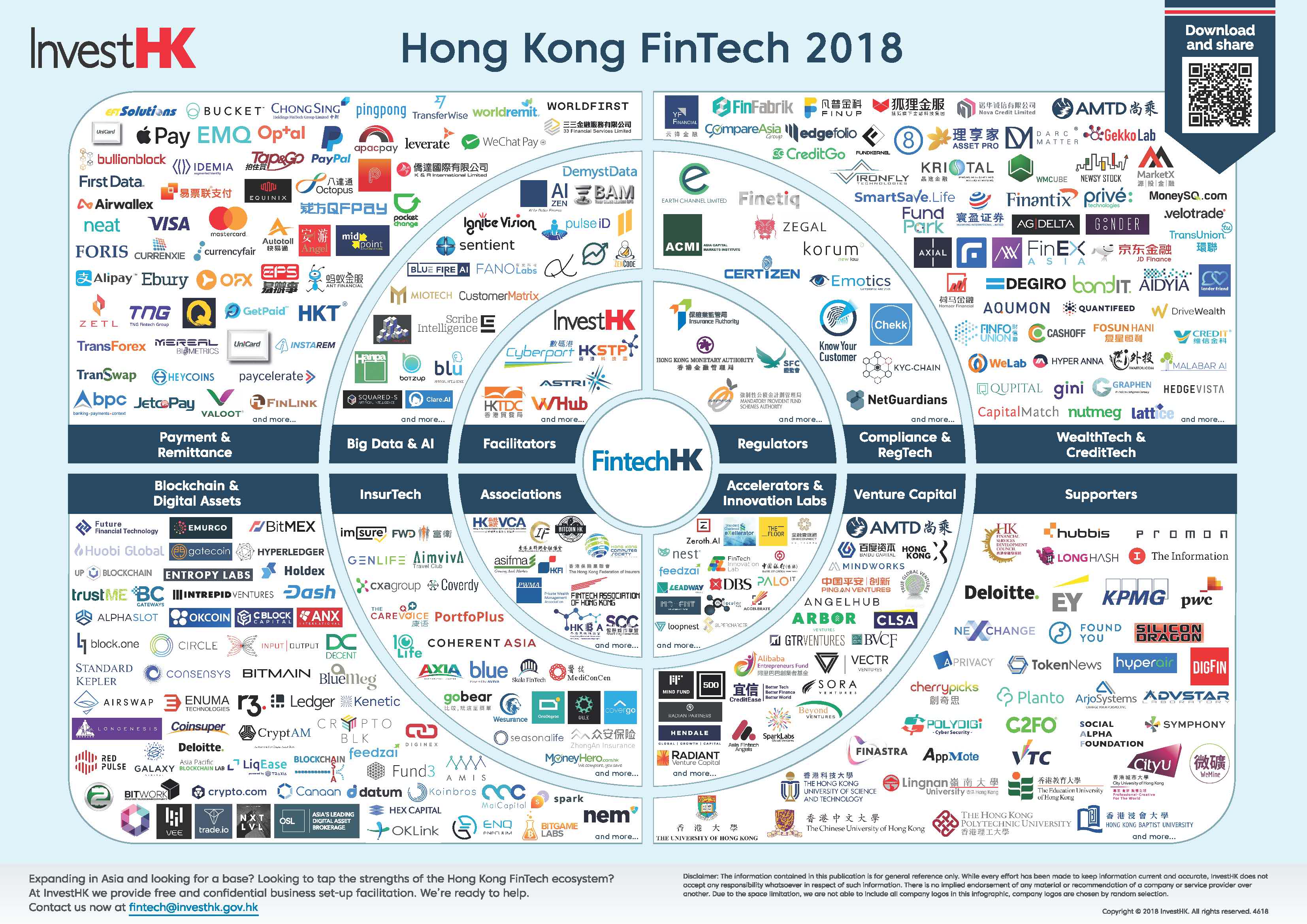

Hong Kong’s fintech startups

Hong Kong’s attractive blend of global capital flows and local investor access, stable legal system and regulatory regime, strong language capability and deep talent pool, have allowed for the emergence of a rich and large fintech startup ecosystem in Hong Kong covering all segments of fintech from payments and remittances, wealthtech and credittech, to blockchain technology and insurtech.

Some of Hong Kong’s most notable fintech companies include online lender WeLab, which is preparing for a US$500 million Hong Kong initial public offering (IPO), and digital wallet operator TNG, which is developing a virtual banking business and looking to expand overseas.

Hong Kong is also home to a number of venture capital firms and acceleration programs aimed at helping promising startups grow. These include Accenture’s Fintech Innovation Lab acceleration program, SuperCharger’s fintech accelerator and the DBS Accelerator.

Additionally, government funding schemes and funds such as Hong Kong Cyberport’s fintech-focused private equity fund, the Innovation and Technology Venture Fund, and the Technology Voucher Programme are there to provide fintech companies with further funding opportunities.

The Hong Kong government’s 2018 budget pledged to allocate HK$500 million to the development of financial services over the next five years, including fintech.

Hong Kong fintech companies have raised a total of US$940 million since 2010, nearly one-third more than the amount raised by Australian fintechs and more than double the amount raised by fintechs in Singapore and Japan, according to Accenture.

Hong Kong’s latest fintech initiatives

The Hong Kong government has launched several new initiatives in the past year aimed at solidifying the city’s leading position as a fintech hub.

These include the Faster Payment System (FPS) and the Common QR Code, launched in September 2018, the Virtual Banking license in May 2018 and the Open API Framework in July 2018. 29 entities have reportedly applied for the new Virtual Banking license. The Hong Kong Monetary Authority (HKMA) is expected to issue the first licenses in the first quarter of 2019.

In October 2018, HKMA launched its blockchain-based banking trade finance platform, eTradeConnect. eTradeConnect combines the services of 12 major domestic and international banks including HSBC and Standard Chartered Bank to enhance cross border trade, and links up with another blockchain platform called we.trade, to allow better trading among a network of 14 European banks including Deutsche Bank, Rabobank, and UBS.