Over the past decade, millions of Chinese investors sunk their cash into thousands of peer-to-peer (P2P) lending platforms. These were promised steady growth, big dividends, and a chance to put financial worries behind. But over the past months, a wave of defaults has swept across the industry, causing investors to withdraw funds and leading platforms to collapse.

Image: China flag, Nicolas Raymond, Flickr.com

China’s P2P lending industry is the biggest in the world valued at 1.3 trillion yuan (US$190 billion), according to the Financial Times. At the end of June, there were more than 1,800 online lending platforms operating in China. The industry channeled loans from 4.1 million investors to 4.3 million borrowers in June alone, according to Online Lending House.

China’s P2P lending industry is now crumbling like a house of cards with its principal casualties being the hundreds of thousands of small investors across China who put their lives savings into the get-rich-schemes, some promising up to 20% annual returns, or several times banks’ deposit rates.

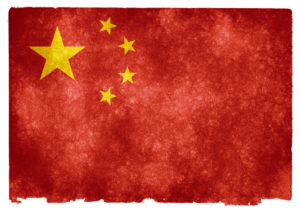

In July, at least 165 P2P platforms had difficulties meeting cash-withdrawal demands, saw their owners abscond with investor funds, or were investigated by police, according to a report by Internet lending research firm Wangdaizhijia. The number was nearly triple that in June, Wangdaizhijia said. P2P lending platforms are supposed to be information intermediaries that match borrowers of small loans with lenders.

An investor on Zhuaqianmao told Inkstone that she lost US$100,000 through the online lending platform. Zhuaqianmao claims to have traded a total amount of US$1.6 billion before shutting its doors in July. The owner of the firm has gone missing.

Xue Liang, founder and CEO of online P2P lending platform Jucaicat has also disappeared, reports the South China Morning Port.

Several other online P2P lending platforms shut down in July, including Qian88.com, which cited “spreading panic among investors” as one of the reasons, and Lqgapp.com, which suspended operations after some investors talked about difficulties securing repayment in online chatrooms, triggering a flood of withdrawal requests. Lqgapp.com had said it would “attempt” to repay its users over the coming three years. About 220,000 investors were owed about 5 billion yuan, as of mid-July.

Online micro lending platform Tangxiaoseng collapsed in June. The company had said it had accumulated a transaction volume of more than 80 billion yuan (US$11.96 billion). As of May 4, the case involved at least 2.88 billion yuan (US$434.9 million). Shanghai police arrested four senior executives of the company in June.

Ezubao, once the biggest player in China, was found in 2016 to be a Ponzi scheme that scammed 50 billion yuan (US$7.6 billion) from about 900,000 investors.

Hepan Finance recently went into liquidation while owning 790 million yuan to nearly 70,000 investors.

A graph by Technode illustrates the soaring default rates of Chinese P2P lending platforms that started in June:

According to Wangdaizhijia, the number of cases filled against P2P lending platform operators jumped to triple digits in July, from 65 cases in June, and just ten in May.

Deceived investors reported their losses to police in Shanghai, Hangzhou and Shenzhen, where most P2P lending platforms are based, but according to Alex Li, the 35-year-old organizer of a demonstration that took place before the country banking regulator earlier this month, investors have been kept in the dark about the progress of the investigations.

Li Weifeng, a 44-year-old Yonglibao investor, told the South China Morning Post:

“I came with great hope to ask for information about our cases, because local bureaucrats all looked out for each other. But they [the authorities] just took us away without even asking.”

In July, Yonglibao’s senior management team posted a letter online informing investors that the company’s owner and chairman Yu Gang and its CEO Zhang Yufeng had disappeared.

The rapid rise and fall of the investment frenzy in China is offering a window into the wild side of China’s economic boom. The money flows and creates a middle class in a generation but regulations are not following the speed of developments to protect investors.

Many who lost money are now questioning why the platforms were allowed to portray themselves as government-approved, and why local authorities could not do more to recover their savings. As of today, it is still unclear whether Chinese authorities will step in to help people recoup their money.

The country’s financial regulators announced ten measures on August 12 to address risks inherent in the industry.

The new regulations require local governments to set up communication channels where investors can complain. New P2P lending platforms and companies are strictly banned. Those that do not repay their loans will be blacklisted under China’s social credit rating system.

Featured image: House of cards, Pixabay.