Mobile payment is a major source of financial innovation which is gaining traction rapidly around the world. China is the number 1 market with US$67.7 billion transaction followed by the United States at US$24.9 billion and the United Kingdom at US$2.8 billion until December 2016 according to Statista. One can see that there is a sizable difference between even the top 3 countries globally.

Hong Kong had made US$229.8 million worth of transactions in 2016 and there are room for rapid growth. If you recall, we wrote about how Hong Kong granted stored value facilities for the initial 5 digital payment players in September 2016 which gave legal certainty over the mobile payment space.

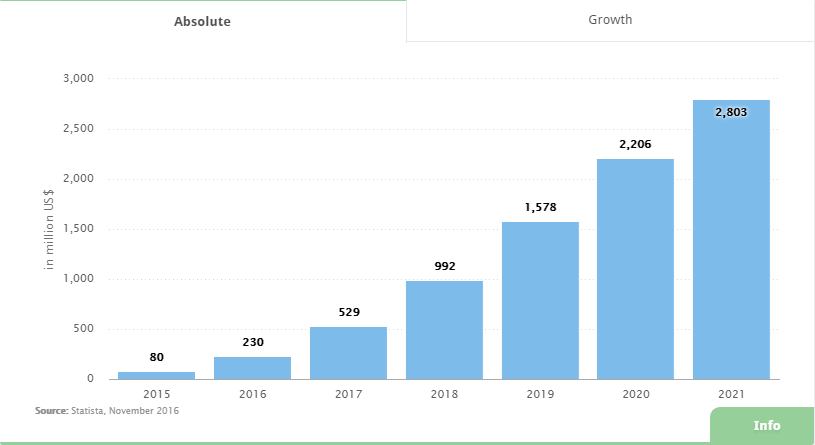

Source: Statista

Statista expects to massive growth of 64.9% compounded annual growth rate from 2016 to hit US$2.8 billion in value in 2021 for Hong Kong. Such huge potential is creating a lot of competition in the city. In this article, we will look at how the market leaders are still up efforts while new entrants attempt to shake up the market.

#1 Hong Kong E-Wallet Player Stepping Up Its Game

TNG Wallet is the #1 e-wallet player with 370,000 registered users but it is not resting on its laurels. TNG had spent the last year introducing its payment solutions to various merchants to help them to save on cost. If merchants were to use Apple Pay or Samsung Pay, they will be charged three times by the credit card issuing bank, merchant’s bank and the e-wallet (e.g. Apple Pay) itself.

TNG Wallet eliminates the above 2 layers of payment and charges a flat fee of 1% to 1.5% to the merchant. TNG Wallet had also tied up with bus companies for commuters to pay for their ride. For this month, TNG Wallet had deepened its relationship with taxi drivers by providing them with HKD$100 to the first 2,000 taxi drivers and HK$1 for each transaction to get them onboard.

The taxi drivers will use their TNG Wallet app to generate a quick response code for the passenger to scan and enter the fare amount. The fare would then be transferred from the passenger’s wallet to the taxi operator’s wallet. In other words, there are no extra cost involved and taxi drivers simply have to get started with this new service.

Challenger Jetco Appears On The Scene

While TNG Wallet had to content with Alipay, Wechat Pay, O! ePay and Tap & Go competitors, it had 1 new significant competitor to contend after September. Jetco had signed with 4 Hong Kong based banks and is in the process of signing up another 2 banks. Their reach is still smaller compared to the 20 banks that are currently working with TNG Wallet.

While Jetco is currently a minnow when compared to TNG, the parentage of Jetco suggest that it can quickly become a threat to TNG. Jetco is the consortium of 30 banks which owns one of the leading ATM network in Hong Kong. In other words, Jetco can quickly sign up more banks than TNG.

The network effect can quickly gain momentum as it becomes easier to send and receive money when your friends are on the same network. Today, TNG is trying to increase its 5% reach of Hong Kong consumers by giving away freebies. If Jetco sets its mind on it, it can easily outspend TNG in customer acquisition and be the next top e-wallet in Hong Kong in 2017.

Conclusion

The e-wallet market is highly lucrative and it is getting started in Hong Kong. E-wallets operators can charge merchants between 1% to 2% of the transaction amount. The transaction market is worth US$2.8 billion in 2021 which means that operators can earn at least US$28 million worth of revenues.

This excludes the fees which they can charge the users themselves once they are hooked onto their e-wallet services as Alipay and Wechat Pay had done in China. Once they are established, they can get merchants to advertise on their platforms and find other creative methods to monetize their presence. Other usage includes cross-border currency transfer, wealth management, insurance and other financial activities.

However, they will have to earn the hearts and minds of Hong Kong consumers first. It would be interesting to find out who will emerge the winner in Hong Kong e-wallet market.