Global Fintech Hub Index 2018: China is The World’s Leading Fintech Hub

by Fintech News Hong Kong July 10, 2018Unsurprisingly, with fintech giants like Alibaba and Tencent Holdings, Chinese cities nabbed top spots in a new Global Fintech Hub Index 2018 (GFHI). Meanwhile Hong Kong ranked 13th in a list compiled to portray global fintech landscapes based on insights from governments, enterprises and consumers across world.

Fintech hubs typically thrive on growing technological adoption by a diverse range of participants, a globalised market, real-time services and a generally flat organisational structure.

Indicators of successful fintech hubs include the availability of demand, capital, talent, and policy regulation within the city. These ultimately help fintech hubs fulfill their potential of becoming the strong driving forces and engines of growth that future global financial markets and economies need.

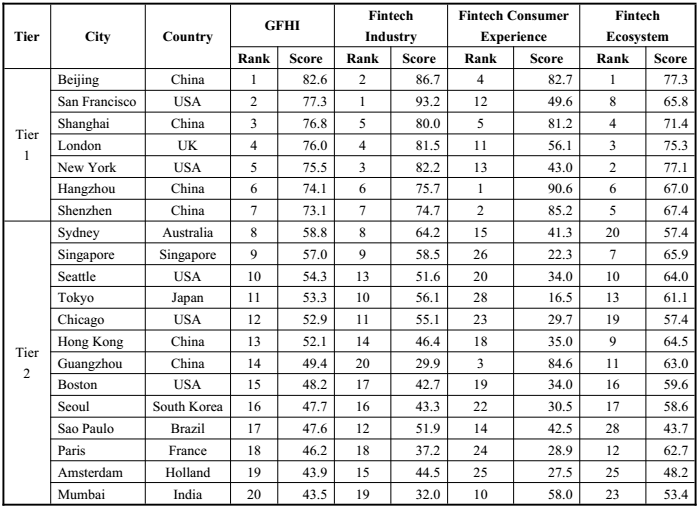

Building on data from enterprises, consumers and governments, GFHI then bases its findings on the following categories:

- Fintech Industry: which is based on the number of fintech companies and total value of venture capital investments in the country

- Fintech Consumer Experience, which measures fintech adoption rates

- Fintech Ecosystem: which measures the potential of future fintech development, based on the policy and regulatory environment, regional macroeconomic performance, and research and development

Using data compiled from a range of sources, the index’s goal is to put forward evidence-based best practices in an effort to promote better understanding of global fintech hubs.

China Cities Dethrone American Cities As Fintech Hubs

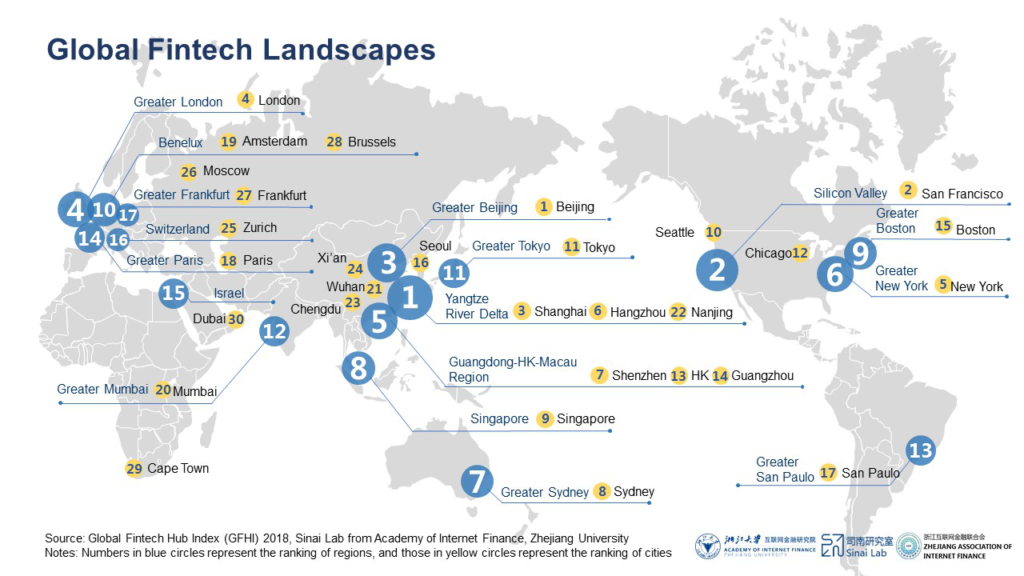

The regional rankings saw the Yangtze River Delta area placed first, followed by the Silicon Valley in second place and Greater Beijing in third. Beijing scored the highest in the city rankings, followed by San Francisco, and then Shanghai.

China’s fintech scene has largely been helped by a welcoming regulatory environment for new fintech firms to get a foothold.

China has also managed to attract the capital it needs to fund new enterprises. Fintech firms there drew up to 1.1 bil USD worth of investments in the first quarter of 2018 alone, according to Fintech Global.

The result has been a much higher adoption rate than most countries. China’s overall fintech adoption rate stood at 69% according to EY’s Fintech Adoption Rate of 2017.

Its closest rival was India, at 52% adoption. Around 83% of Chinese consumer surveyed used fintech services to conduct money or payment transfers, the fintech segment with the highest adoption rates there.

Meanwhile 58% used them for savings and investments purposes. Around 47% used accessed insurance products through fintech.

Hong Kong Ranks High but Still Falls Behind Singapore

By contrast, HK’s fintech adoption rate stands at 32% as of 2017. Although scoring the 13th spot in the city rankings, Hong Kong has not managed to unseat Singapore, which still ranks eighth in the index.

Singapore’s strong regulatory environment and clear frameworks have largely been contributory to its ongoing success as a fintech hub.

Yet Hong Kong has seen no less encouragement in that sense. Its 2018-2019 budget tabling set aside 500 mil HKD for developing financial services over the next five years. It set a further 50 mil HKD aside for innovation.

Paul Chan

“To shine in the fierce I&T (innovation & technology) race amidst keen competition, Hong Kong must optimise its resources by focusing on developing its areas of strength, namely biotechnology, artificial intelligence, smart city and financial technologies (Fintech), and forge ahead according to the eight major directions set out by the Chief Executive,” Hong Kong’s financial secretary Paul Chan during the budget speech.

So far, 2017 investments into HK fintech firms are showing progress, having risen to US$545.7 bil, from US$215.3 mil the previous year. Hong Kong banks and financial institutions could be the next driver of growth here, even as they look to harness the fuller potential of fintech in financial services.