CEOs of companies headquartered in mainland China and Hong Kong are optimistic about the growth outlook of the global economy and their companies, and are actively investing in innovative technologies and pursuing M&A to achieve their growth objectives, finds a new KPMG survey.

The report, titled Collaborating and innovating for growth – 2018 China CEO Survey, features China findings from a global KPMG survey of 1,300 CEOs worldwide –including 125 from mainland China and Hong Kong – across a wide range of industries.

The survey finds that three-quarters of China CEOs are confident about the growth prospects of the global economy, a marked increase compared to 54 percent in 2017.

Meanwhile, confidence in the growth outlook for their companies remains unchanged – at a high level of 90 percent – from 2017. This can be seen with 84 percent of China respondents expecting an overall increase in their organisation’s headcount over the next three years, and with 44 percent expecting an increase of more than five percent.

Benny Liu

Benny Liu, Chairman, KPMG China, says:

“This optimism is evident in the senior executives we speak with, who tell us that they are embracing technological disruption as an opportunity to collaborate with innovative start-ups, create a more digital workforce, and invest in big data analytics, artificial intelligence (AI) and other advanced technologies.”

The survey results show that an overwhelming majority of China CEOs (91 percent) view ‘technological disruption’ as more of an opportunity than a threat, an increase from 75 percent in 2017.

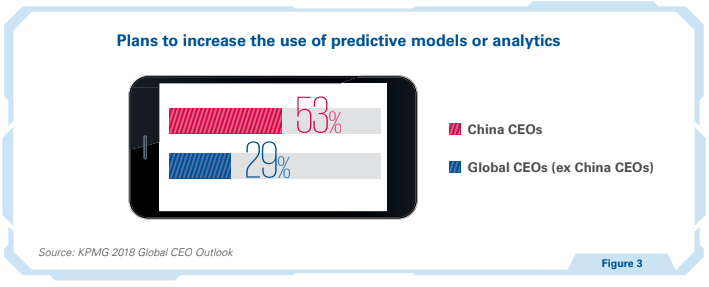

More than half of them say they have implemented AI, with the key benefits including the improvement of data analytics capabilities, data governance and customer experience. Furthermore, more China CEOs (53 percent) than their global peers (29 percent) plan to increase the use of predictive models or analytics over the next three years.

Additionally, more China CEOs than their global peers intend to collaborate with innovative start-ups, join industry consortia focused on the development of innovative technologies, and increase investment in disruption detection and innovation processes.

Honson To

Honson To, Chairman, KPMG China and Asia Pacific, says:

“The promotion of innovation is also a key priority under the 13th Five-Year Plan, and the Chinese Government has actively cultivated new industries, encouraged innovation in technology, products and business models, and sought to establish a platform for high-end R&D.”

Meanwhile, the adoption of new and disruptive technologies can also create a number of risks. The survey finds that China CEOs view “emerging/disruptive technology risk” as a potential challenge to growth. Others include “a return to territorialism” (perceived risks such as the US renegotiating NAFTA and the UK leaving the EU), “environmental/climate change risk” and “reputational/brand risk”, which indicates that China CEOs are taking the geopolitical landscape into consideration, as well as how their actions impact public perception and the environment.

Cybersecurity is also cited as an important issue for China CEOs. The survey results show that significantly more China CEOs (74 percent) than their global peers (52 percent) agree that a strong cyber strategy is critical to engender trust with key stakeholders.

M&A and collaborative growth are also high on the agenda for many China CEOs. More than three-quarters of them indicate either a “moderate” or “high” appetite for M&A in the next three years, in order to take advantage of favourable valuations, reduce costs through synergies/economies of scale, and to transform their organisations’ business models faster than organic growth will deliver.

Nearly two-thirds of surveyed China CEOs say their organisations will prioritise emerging markets for expansion over the next three years, with Central and South America, Eastern Europe and Asia Pacific the three key emerging market regions.

To says:

“This strong M&A appetite and focus on emerging markets is understandable, as China’s influence on the global economy continues to grow, and key strategic national initiatives like the Belt and Road Initiative and developments in the Greater Bay Area are helping to drive trade, investment and economic growth in the region.”

Partnering between Chinese and international firms is also emerging as an attractive growth strategy. This is indicated in the survey results, where more than three-quarters of China CEOs rank “strategic alliances with third parties” as a key growth initiative. Furthermore, a significantly larger proportion of China CEOs than their

global peers agree that the only way for their organisation to achieve the agility it needs is to increase the use of third-party partnerships. Liu concludes:

“This will help companies localise their investments and build trust with local and international stakeholders, complement their respective comparative advantages to jointly develop third-country markets, and locate more investable opportunities along the Belt and Road.”