Tapping a $US 600 Billion Global Market, 8 Securities Launches Robo‐advisor App “Chloe” in Hong Kong

by Fintech News Hong Kong December 9, 20168 Securities, Asia’s first robo-advisor launched Chloe on Google Play and the Apple App Store. The service is free for accounts under HK$8,888.

How does Chloe work?

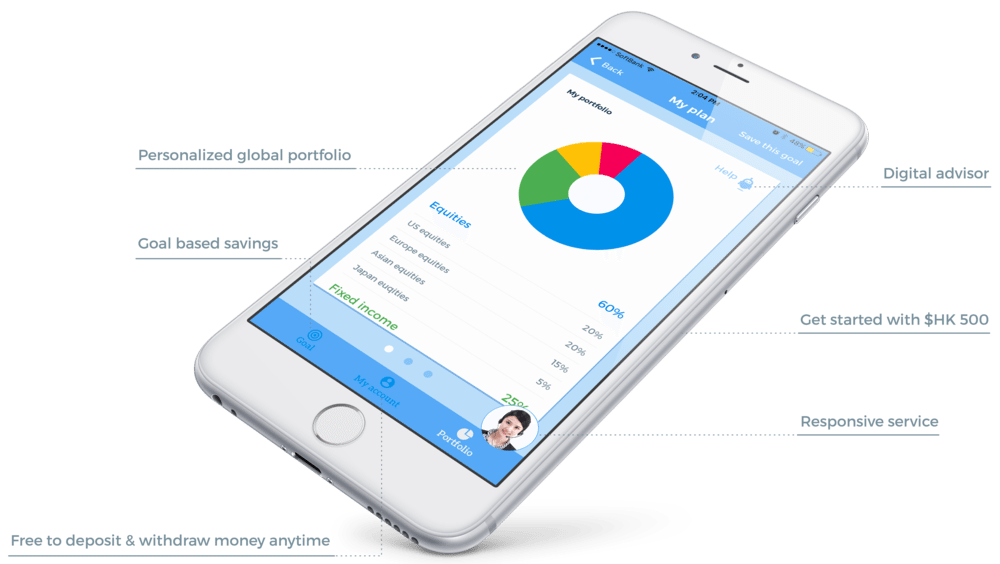

Customers start by answering a short survey to set goals and a target date to achieve them. Each dollar the customer deposits is intelligently invested into a diversified global portfolio of exchange traded funds. Chloe monitors and optimizes the investment on a daily basis to help customers stay on track. Chloe becomes more intelligent over time by using machine learning to better predict customers goal and how much they need to save.

“We believe Chloe holds many advantages over private banks and wealth management firms whose investment minimums and costs make such services out of reach to 90% of the population”, said 8 Securities.

On a global basis, customers are expected to deposit over $US 600 billion in robo-advisors by 2017. Hong Kong is expected to grow from $US 400 million to over $US 20 billion by 2020 based on research by Aite Group. 8 Securities went on to say “we recognize customers want mobility, simplicity and transparency when it comes to their money. “

Advantages of Chloe

Low cost

Customers can start investing in their personal goals with as little as HK$ 1,000. The service is

free for accounts under HK$8,888 and 0.88% annually above HK$8,888.

Flexible

Unlike other advisory services and mutual funds, customers are free to deposit or withdraw their money anytime with no fees and no questions. Chloe gives you a flexible solution to save for the future with the power of investing.

Global

Each customer’s personal portfolio is diversified across as many as 28 countries, 34 industries

and 1,637 stocks and bonds using exchange traded funds.

Intelligent

Chloe monitors each customer’s goals and optimizes the investment portfolio by partnering with world-class advisors. Machine learning improves goal prediction and its values over time.