Hong Kong Mobile Banking Startup Neat To Begin Beta Testing

by Fintech News Hong Kong December 5, 2016Neat, a neo-bank in Hong Kong, will start releasing invites to its app at its beta events on December 07, 08 and 13. Announced earlier this year, the new service promises a new banking experience that is entirely digital targeted at millennials.

“We started building Neat because lots of people aren’t getting the help they deserve when it comes to managing their finances,” the company says. “Especially young people get ignored by traditional financial institutions – because they are unprofitable customers. As a result, there are very few products that serve their needs. So we set out to make a change.”

Neat: how it works

The first of its kind in Hong Kong, Neat provides a mobile current account accessible solely through its mobile app. This allows Neat to be 16 times cheaper than a bank in terms of running costs, according to Neat founder David Rosa, a former banker.

Setting up an account takes only 10 minutes and everything is done through the Neat App. When opening an account, users get a prepaid MasterCard, provided by Neat’s partner ePaylinks, as well as a prepaid card account.

The payment card allows them to make purchases online and in store in over 50 currencies where MasterCard is supported. They will also be able to withdraw cash at any ATM around the world which accepts MasterCard.

The payment card allows them to make purchases online and in store in over 50 currencies where MasterCard is supported. They will also be able to withdraw cash at any ATM around the world which accepts MasterCard.

Rosa told the South China Morning Post that both the app and accompanying payment card will be using facial recognition technology to verify the person on the Hong Kong identification card is the same person opening the account. This would allow customers to use selfies to verify their identities.

Users can top up their wallet either from a traditional bank account or by “pulling” in cash from the app, Rosa told the media outlet.

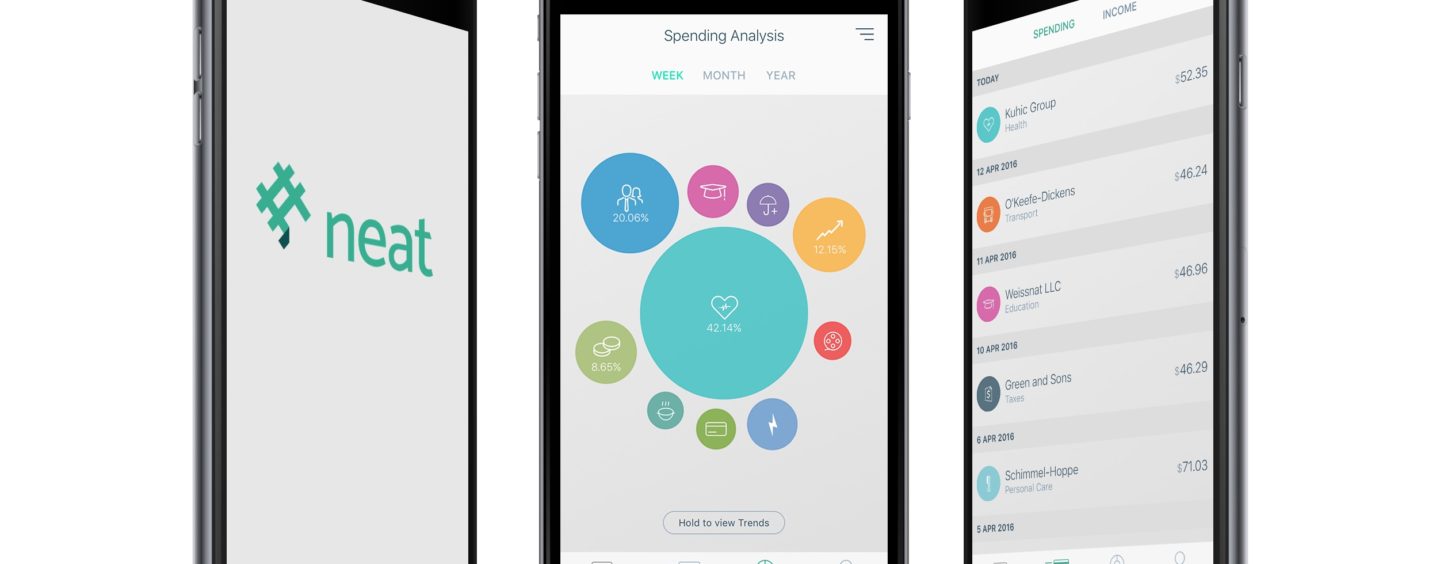

The app also provides a number of tools. For instance, it automatically categorizes each expense and shows the user how much he or she has spent on different categories over the week, month and year. These features help for budgeting and fixing saving goals.

Security features for the card include the ability to “switch it off” if it has been misplaced before reporting it lost, and to turn the online shopping ability on or off at will.

Neat uses artificial intelligence and machine learning to gain in-depth understanding of its users. The company’s monetization model combines taking a cut of the fee charged by merchants to process the transaction as well as collecting and analyzing data for brands, Rosa told the South China Morning Post.

He said that Neat will class the anonymized data into behavioral clusters to give brands insights into consumer patterns, including spending at rival stores. In return, users will be given targeted discounts.

“Neat is an Artificial Intelligence company doing banking, not the other way around,” Rosa said, as quoted by Finextra. “If Google or Facebook were to build a banking solution; this is how they would build their business model.”

Neat is the result of Rosa’s previous artificial intelligence startup Variably and the technology behind payments startup TofuPay, which the company acquired.

Compared to mainland China, Hong Kong is fallen behind in terms of mobile payments, Rosa said. “That is an opportunity as the timing is very ripe for this type of solution,” he said. “Contactless payments are the fastest growing means of payment in the world.”

In 2015, third-party mobile payments in mainland China reached 16.36 trillion yuan (US$2.36 trillion), according to research fir Analysys. Alibaba’s Alipay took over 70% of the market in the third quarter.

Neat is an alumnus of the SuperCharger fintech accelerator program backed by Standard Chartered and Fidelity International, among many other large firms.

Featured image via Neat.hk