Asia Leads the Way with Central Bank Backed Digital Currencies (CBDCs)

by Fintech News Hong Kong April 29, 2021Central banks in Asian countries including Cambodia, Thailand, Mainland China, Hong Kong and Singapore, have more advanced central bank digital currency (CBDC) projects than their global counterparts, outperforming those of Canada, the UK and Sweden, a new analysis by PwC shows.

The PwC Global CBDC Index 2021, released earlier this month, measures central banks’ level of maturity in deploying their own digital currency, considering the progresses made so far, their stance on CBDC development, and public interest.

The index gives a ranking of the world’s top ten most mature CBDC projects in two distinct use cases, namely retail CBDC projects, and interbank/wholesale CBDC projects, revealing that for both categories, Asian nations rank at the top of the list.

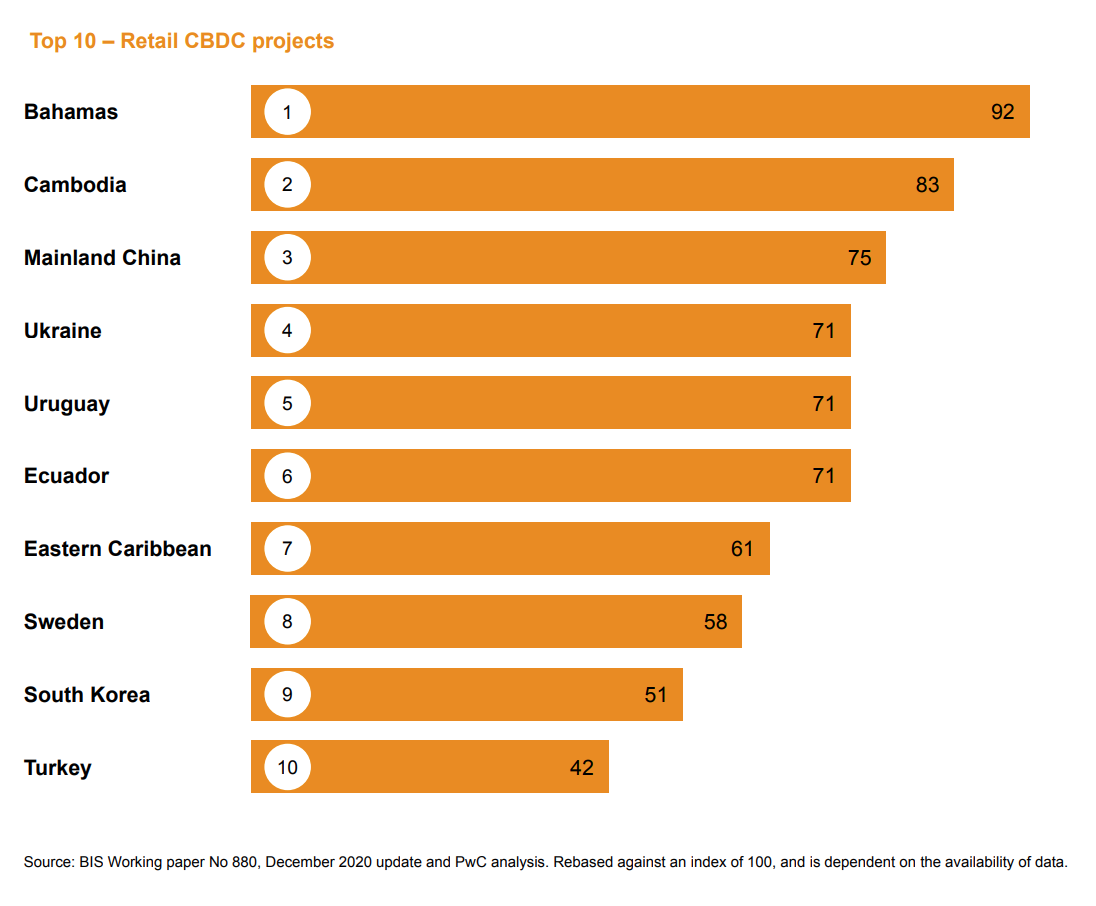

Cambodia and Mainland China among most mature retail CBDC projects

For retail CBDC, initiatives are particularly strong in emerging economies where financial inclusion and digitalization are key drivers, the report says. It notes that currently two projects are live: the Sand Dollar in the Bahamas (#1) and Project Bakong in Cambodia (#2).

The Sand Dollar, a digital version of Bahamian Dollar, was officially launched by the Central Bank of the Bahamas in October 2020 after a pilot phase that began in December 2019. The CBDC is issued through authorized financial institutions and is accessible to all residents through a mobile wallet and a physical payment card.

In Cambodia, the central bank started exploring digital currencies back in 2018. Project Bakong, a distributed ledger technology (DLT)-based interbank payment system, began testing in July 2019 and was officially launched in October 2020. The system links 11 domestic commercial banks and payment processors, and allows interbank, real time electronic transactions. In parallel, the National Bank of Cambodia has been exploring the possibility for cross border transactions with Malaysia’s Maybank since October 2019 with hopes for cheaper and more efficient remittance services for overseas workers.

Mainland China ranks third for its Digital Currency/Electronic Payment (DC/EP) project, a CBDC initiative that aims to improve the convenience, the efficiency and the resilience of the retail payment system. The country began the development of its retail CBDC back in 2014 but it wasn’t until April 2020 that a pilot phase started. Today, DC/EP is arguably the most mature retail CBDC project by a major economy, and the project has already reached an advanced level of trialing with more than 2 billion yuan (US$300 million) having been issued by the People’s Bank of China (PBoC) to commercial banks

Top 10 retail CBDC projects, PwC Global CBDC Index 2021, April 2021

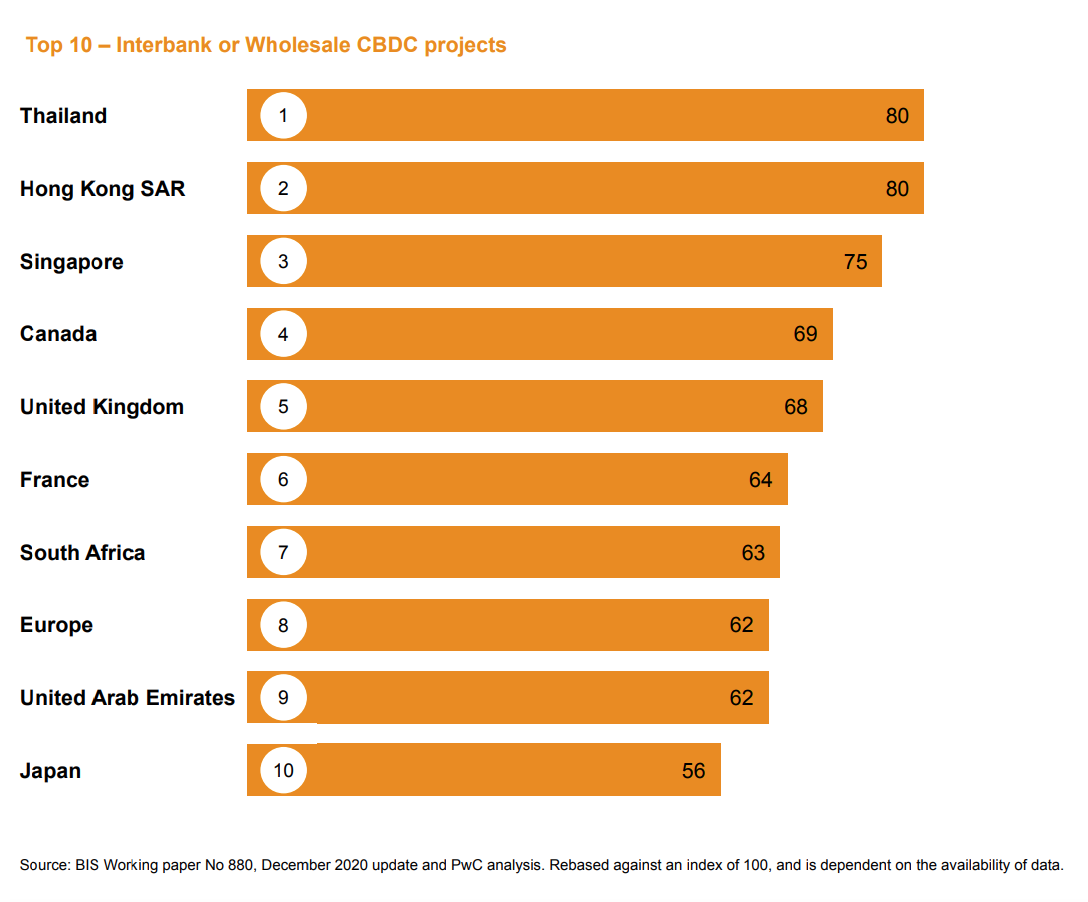

Thailand, Hong Kong and Singapore lead in interbank/wholesale CBDC

In the interbank or wholesale CBDC category, there is currently no live projects despite there being very advanced pilot initiatives that are now expanding their scope to test cross-border connectivity and interoperability.

Thailand and Hong Kong rank neck-and-neck at the top of the list, recognized for their joint Project Inthanon-LionRock study. Initiated in 2019 by the Hong Kong Monetary Authority and the Bank of Thailand, the joint study aims to test the application of CBDC in cross-border payments with ambitions, in the long run, to evolve from a bilateral system to one that supports multiple jurisdictions and multiple currencies.

Project Inthanon-LionRock entered Phase 2 this year during which it will focus on developing a software prototype to enable cross-border settlement in CBDC as well as exploring a range of different use cases. The United Arab Emirates (UAE) and Mainland China recently joined the initiative.

At the third position is Singapore and Project Ubin, an initiative the Monetary Authority of Singapore (MAS) launched in 2016. Project Ubin, which completed its fifth and final phase in July 2020, sought to explore the use of blockchain and DLT for clearing and settlement of payments and securities. The last phase included the development of interfaces to establish connections to other blockchain networks.

MAS is now looking to collaborate with other central banks and has announced its intention to cooperate with the PBoC. DBS, JP Morgan and Temasek are currently collaborating on the development of a blockchain-enabled clearing and settlement network. The platform, called Partior, will start with a focus on facilitating flows primarily between Singapore-based banks in both USD and SGD with the intent to expand service offerings to other markets and in various currencies.

Top 10 interbank or wholesale CBDC projects, PwC Global CBDC Index 2021, April 2021

In 2021, CBDCs continued to gain traction with development accelerating and institutional involvement continuing to grow. Since 2014, more than 60 central banks have explored CBDCs with public stakeholders such as the Bank of International Settlements, the World Bank, the International Monetary Fund and the World Economic Forum actively working on the topic.

PwC’s research into active CBDC projects also found that blockchain is the technology of choice with more than 88% of projects currently in pilot or production phase using it as the underlying technology.

Among the key benefits of blockchain, the report cites the possibility for programmable smart contracts, transparent audit trails, configurable confidentiality features, increased interoperability with other digital assets, and the ability to securely share value and transfer ownership.

Featured image credit: Photo by Thom masat on Unsplash