A white paper by the Hong Kong Financial Services Development Council (HKFSDC) is examining how Hong Kong can develop its blockchain capabilities to serve the region.

According to the paper, Hong Kong, with its large financial sector and its strategic role vis-à-vis Mainland China and the world, has the potential to take on an important role in distributed ledger technology (DLT). Investment in DLT would be a crucial step towards preparing Hong Kong across a broader front for a more technology-intense future.

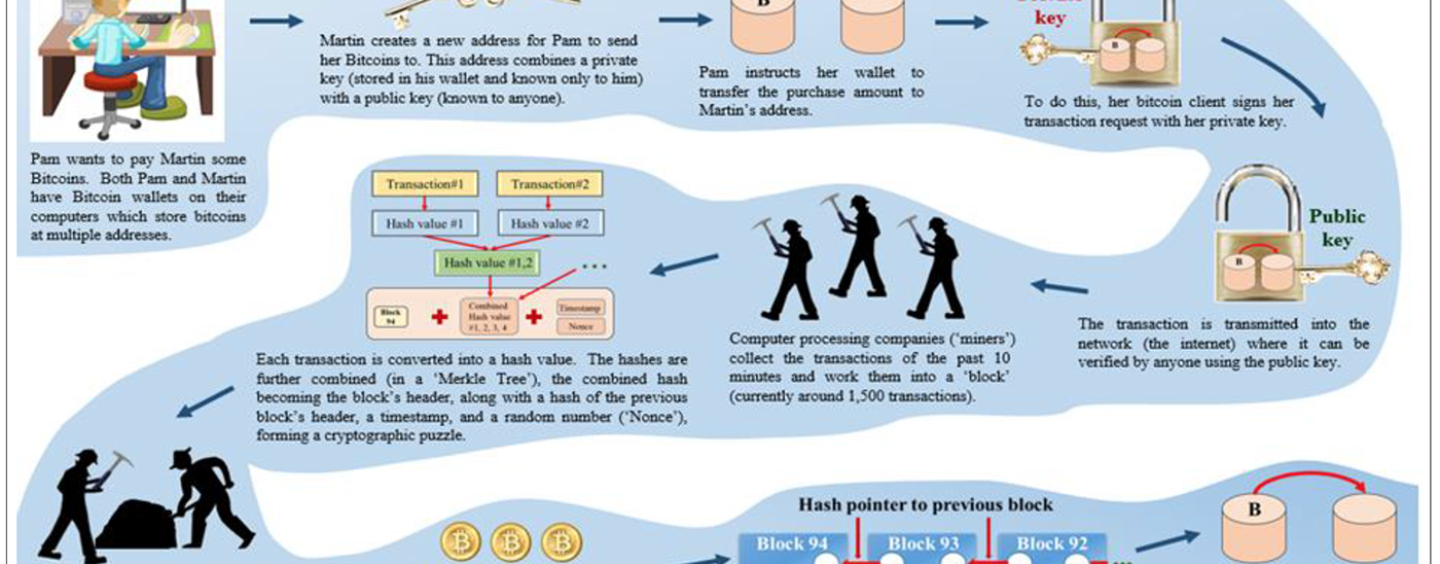

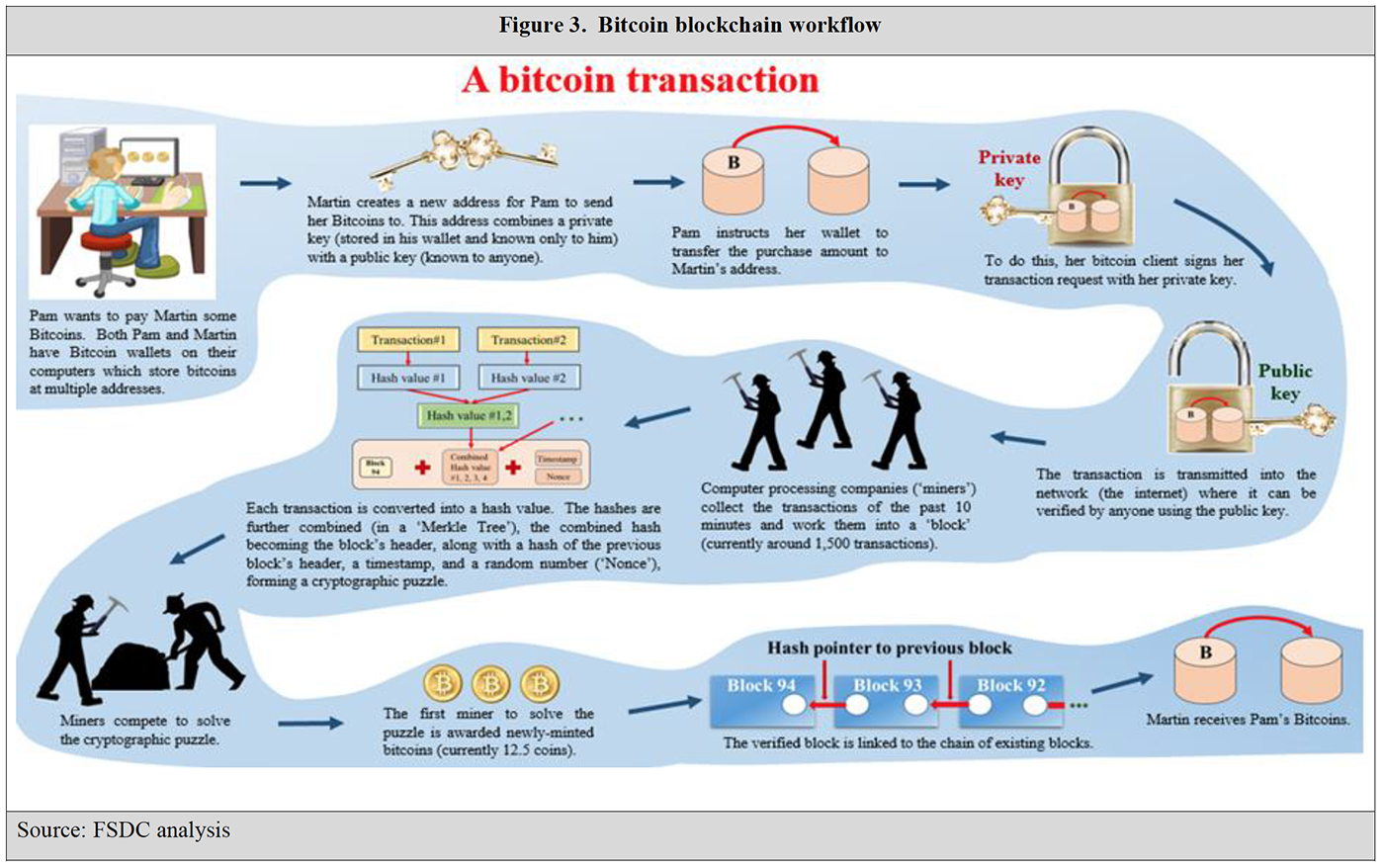

Bitcoins are an example on how blockchain works to encrypt financial transactions. Blockchain’s proposition is of a ledger which is distributed rather than centralised. The technology allows the ledger (transaction record) to be distributed – meaning that each participant has a copy – rather than centralised, and the ability to write to the ledger is distributed as well.

DLT in Asia

DLT may be a developing technology. But its proposition is so compelling that a number of other jurisdictions are investing in it now in order to carve out a role for themselves in a future DLT-enabled world. Hong Kong, with its large financial sector and its strategic role vis-à-vis Mainland China and the world, has the potential to take on an important role in DLT.

In the region, Singapore is establishing a blockchain innovation centre and is eyeing a role as the Southeast Asia hub. Mainland China is focusing on blockchain for finance; the central bank has formed a team to consider blockchain as a possible technology to develop digital renminbi (RMB).

In Hong Kong, exploration of DLT has begun. The Cyberport and Science Park are providing support for technology start-ups; work has commenced on DLT proof-of-concepts (PoCs).

However, there are shortfalls in innovation and technological capability, and the all-important ecosystem is not yet functioning, said the paper. It adds that Hong Kong needs to act decisively to secure a role for itself in a DLT-enabled future.

Proposed solutions to challenges

The white paper notes that DLT adds a layer of trust to the Internet. For instance, it reduces the opportunity for fraud by preserving a full transaction history. DLT could transform finance; it could contribute at many levels to the ‘smart city’ concept.

The issues include scalability, latency and data privacy. Fraud and hacking of e-wallets are also concerns. Regulators, governments and users need to be comfortable with the technology’s implications. Nonetheless, financial institutions (particularly banks), businesses, academics, regulators and public bodies around the world are experimenting with the technology.

Hong Kong has the opportunity to build on its existing strengths with DLT, and secure its future in a DLT-enabled world. The paper proposes that:

- Government lead DLT development. It should create a DLT lead function within government, supported by an advisory group from industry and academia. This lead function would help coordinate public sector efforts on blockchain, engage regulatory support, build DLT capability within the public sector, and promote the technology.

- Develop a DLT Hub as focal point for the technology ecosystem, a centre of knowledge, education and advocacy, and a go-to place for ideas and contacts. The hub should incorporate a DLT Laboratory to reduce the cost of testing and support the emergence of common standards. The hub could be funded by the public sector (including the regulators), industry bodies and/or other sources where appropriate.

- Digital currencies. Ensure that the Hong Kong financial system and legislative and regulatory framework are positioned to capitalise on the likely issuance of digital RMB by the Mainland Chinese authorities.

- Demonstration projects. Initial work in developing blockchain-based PoCs for certain specific activities in Hong Kong has already begun, including projects conducted by Hong Kong Applied Science and Technology Research Institute (ASTRI) as commissioned by the Fintech Facilitation Office of the Hong Kong Monetary Authority (HKMA)

As Hong Kong gains experience with DLT broader and deeper programmes should be launched, wrote the paper. Legal support may be needed. For example, for the recognition of digital assets, and regulatory waivers (‘sandboxes’) for the exploration of new digital models. Government services could also be digitised, and a range of blockchain use-cases implemented for greater efficiency.