Preparing for 2020: Hong Kong Financial Services’ Top 5 Priority Responses

by Fintech News Hong Kong September 25, 2016The pace of global change in financial services continues to accelerate as market incumbents, emerging FinTech startups and newcomers of every kind try to offer more sophisticated yet convenient means of moving money. Nowhere is this trend more apparent than in Hong Kong; the city that prides itself on being the financial gateway to the rest of China as well as a hugely influential international finance hub in its own right.

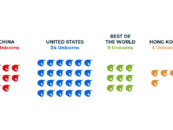

An emerging shift in financial and economic influencing factors means that Hong Kong’s status as the primary financial hub in China is under threat from the rest of the mainland, where increasing demand for more sophisticated financial services has led to the emergence of new market entrants such as online-only banks and other FinTech startups.

In order to retain its prominence in Chinese and international finance, Hong Kong needs to fully recognise the importance of the current influencers in order to develop the right strategic responses that will help keep product offerings relevant and competitive.

TOP 5 PRIORITIES RESPONSES FOR HONG KONG’S FINANCIAL SERVICES

Fintech Disruptions

Market incumbents need to understand the transformational potential of FinTech disruptors and actively seek out strategic partnerships that will help them shape new and exciting product offerings, rather than continually playing catch-up with more dynamic competitors.

Blockchain

The Hong Kong Monetary Authority is already exploring the potential of blockchain applications

with a view to implement regulatory oversight in the near future and issue guidelines on the

technology’s adoption by financial institutions.

“By nurturing fintech start-ups, such as those that are exploring possible uses for blockchain, Hong Kong positions itself as being able to lead in the future disruptive banking services that will shape finance.” – Jon Allaway, Accenture Financial Services

From Pixabay

The Rise of The Sharing Economy

In order to appeal to modern digital banking consumers, traditional financial services providers, such as major incumbent banks and lending houses will need to galvanise their existing services by improving speed and convenience, either by developing their own bespoke platform or by partnering with the appropriate payments service providers.

Rising Cybercrime

Cybercriminals are becoming more ambitious, daring and sophisticated in their approach. Only by thoroughly analysing existing ICT infrastructure and implementing a holistic cybersecurity solution can a financial services company hope to effectively protect itself from cybercriminals.

Cloud-based Infrastructure Model

The shift towards the cloud is gathering pace as all manner of market sectors become increasingly

comfortable using cloud-based infrastructure, recognising its potential for providing versatility

and realising operational cost reductions.

>> Download full article: Preparing for 2020: Hong Kong Financial Services’ Top 5 priority responses

If you’re into Hong Kong’s financial services, join us at Digital Financial Services Hong Kong Summit taking place in Hong Kong on 29 – 30 November. Key topics to be addressed in 2016 include:

1. Redesigning your product development & delivery process to enhance user experience and engagement

2. Strategizing internal processes & communication strategies to maximize efficiency and minimize costs

3. Integrating risk & compliance management as part of the digitization strategy to reduce structural cost and operations risk

4. Leveraging on FinTech and innovative business models to stay ahead of your competitors

5. Recognizing the applications of artificial intelligence in driving digital strategies

Special Offer: Sign up now with code “FINTECH_10” to get 10% dicount

Find more Fintech events in Hong Kong to attend here

Featured Image: from Pixabay

This article first appeared on Fintech News Singapore