Banks should look at Design Thinking as a way to compete with the emerging fintech sector

by Fintech News Hong Kong April 27, 2017A report by Oliver Wyman and IESE Business School suggests that banks should leverage “Design Thinking” to evolve their business models, in an era where traditional ways of doing business are threatened by the prolifetation of fintech.

In the financial services industry, there are several long term trends that are reshaping how the industry operates. The trends can be grouped into six areas, namely digital disruptions, increased regulation, changes in customer behaviours and dynamics, a low growth environment with lax monetary policy, increasing competition by fintech players, as well as complex decision making processes.

According to the current industry trends, innovations related to customer experience improvements are becoming more and more critical, said the report. This is why Design Thinking, as a tool to innovate, will grow in importance.

What is design thinking?

Design Thinking is a tool for innovation, which uses a consumer-centered approach that puts the discovery of highly detailed consumer needs at the forefront of the innovation process.

In Design Thinking, the focus is shifted towards the end user. This is achieved by an empathy exercise: trying to better understand customer needs and behaviors from their own perspective. By engaging in Design Thinking and getting closer to the end customer, banks are better able to understand the reasons behind those actions, and in turn prepare for possible future patterns of behavior if the same reasons remain in play. Design Thinking is also accompanied with a stimulating atmosphere that promotes new ideas and encourages the participation of the entire tea

The Design Thinking Process Overview

The study, which researched 17 large financial institutions from 11 countries and which involved interviewing groups of senior bank executives, noted that banks have begun to set up innovation labs and to apply Design Thinking within their organisations. However, they struggle to make it part of their day-to-day culture and processes. In fact, 63 percent of respondents to a recent survey of chief innovation officers, user experience senior consultants, and individuals tasked with innovation and design said that Design Thinking initiatives did not advance and lead to successful solutions.

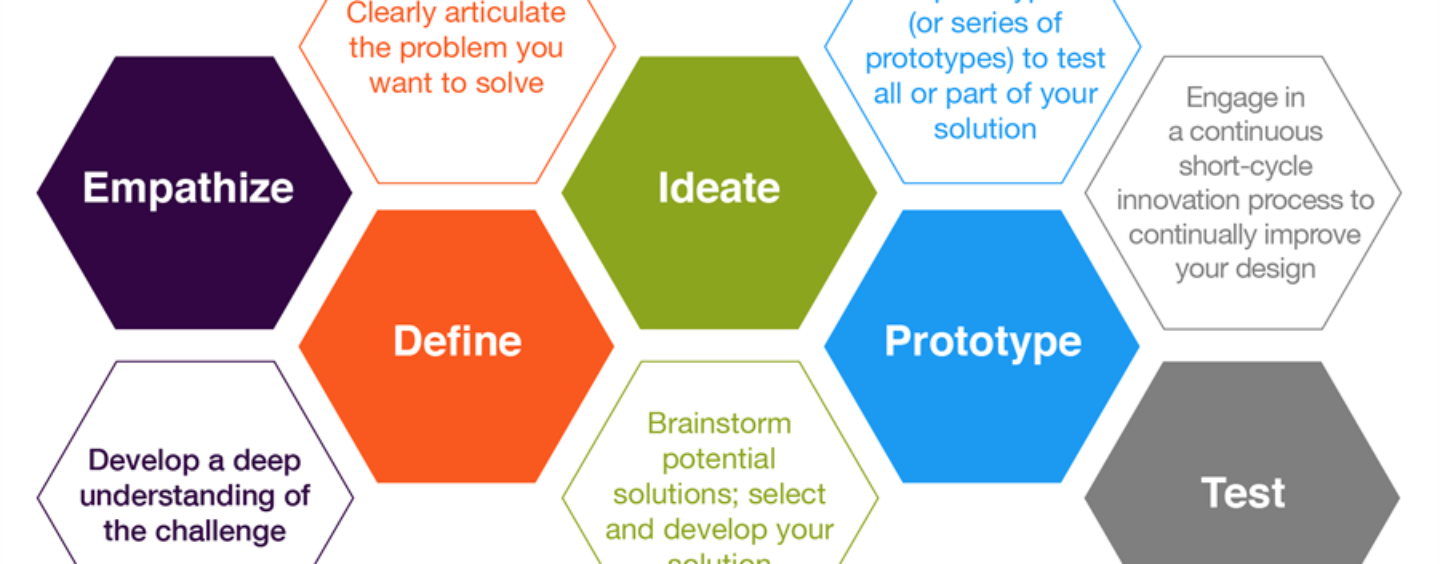

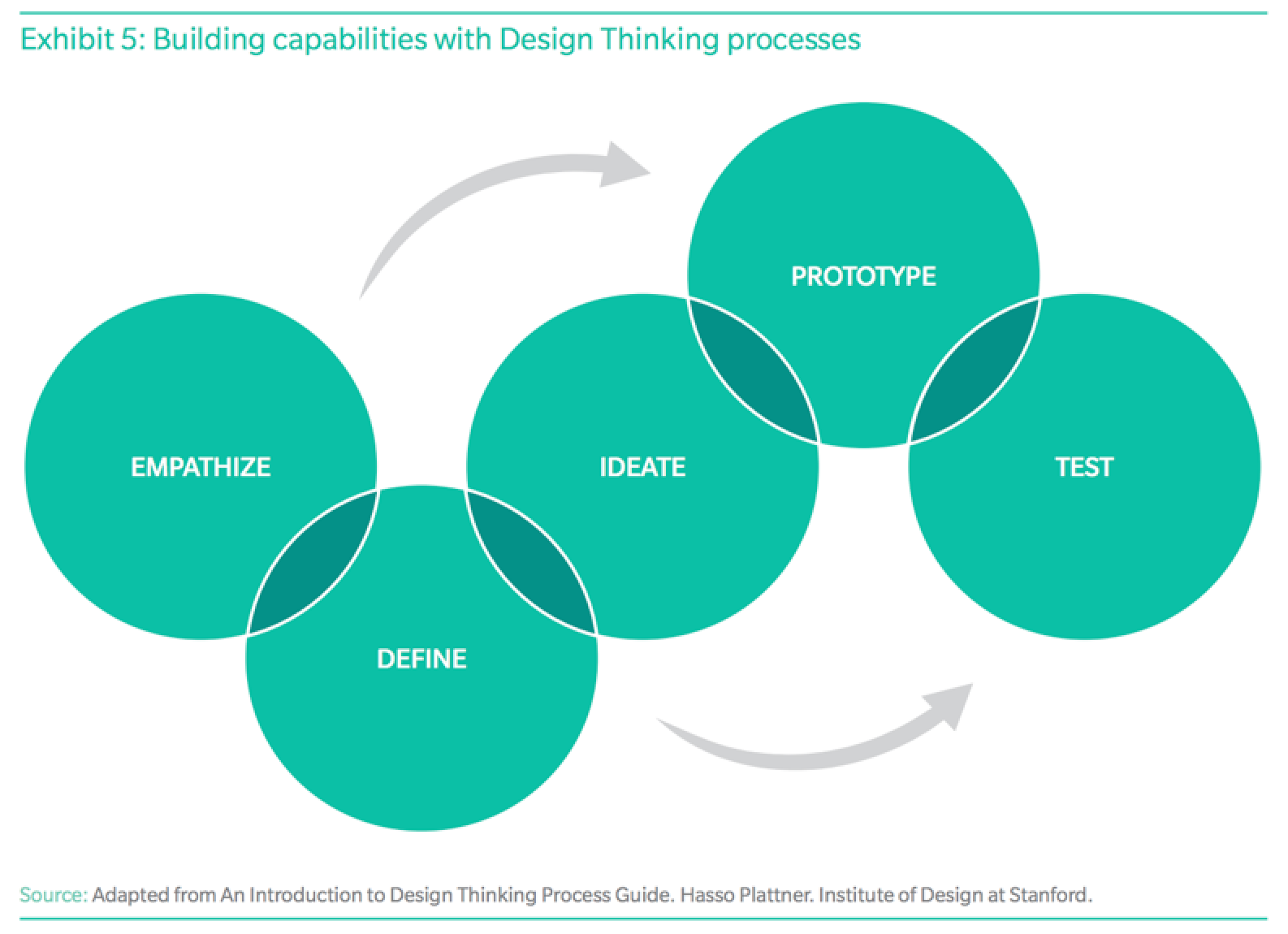

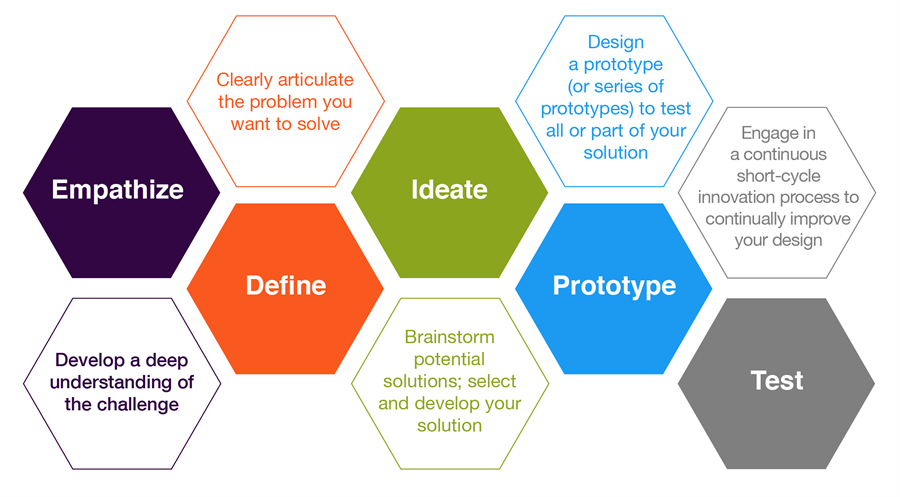

The Design Thinking process can be split in the following five stages: Empathize, Define, Ideate, Prototype, and Test. In processes that are human-centric, empathy is essential to understand the problems and needs of the end users, and to model the firm’s strategy. “Define” involves reviewing all the information gathered during the “empathise” stage in order to define the problem that is to be solved, and start setting goals and objectives.

“Prototypes” is necessary once the ideas have been generated. It is essential to start producing cost effective and simple prototypes that generate feedback from potential users or developers.

“Ideate” is encompassed within the operational application of Design Thinking. At this stage, the objective is to think about new ways to solve the problems identified with your business strategy. “Test” is the next phase, in which the purpose is to get feedback from the end users.

Challenges in applying Design Thinking

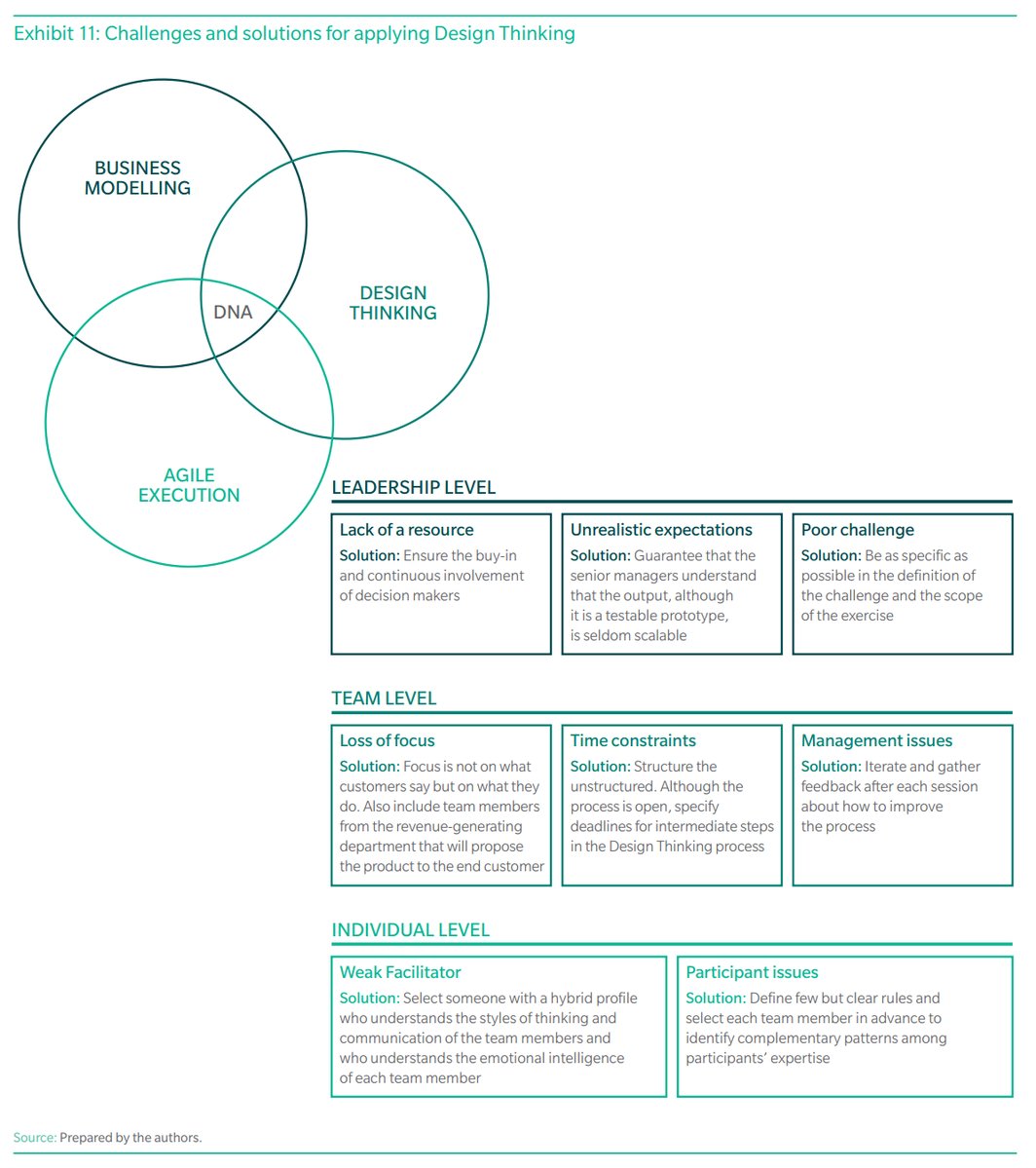

From the authors’ research, there are three main challenges when it comes to mplementing Design Thinking. They are namely leadership, team, and individual. At the leadership level, there was a lack of resources to carry out the last stages of the Design Thinking process. At the team level, there was a loss of focus during the process, time constraints, and other specific management issues. At the individual level, the team leaders were sometimes described as weak facilitators, and there were also some participant issues.

From the authors’ research, there are three main challenges when it comes to mplementing Design Thinking. They are namely leadership, team, and individual. At the leadership level, there was a lack of resources to carry out the last stages of the Design Thinking process. At the team level, there was a loss of focus during the process, time constraints, and other specific management issues. At the individual level, the team leaders were sometimes described as weak facilitators, and there were also some participant issues.

There are successful instances where Design Thinking has been applied successfully. The report cited the case of OCBC Bank Singapore. Through Design Thinking principles, a diversified team within OCBC Bank developed the initial product concept based on customers’ insights. The team prototyped communication ideas with front-line employees, using simple materials and stationery.

By involving employees in the process, the team earned how to explain the product in a simple and compelling way. Eventually, OCBC Bank increased sales of its new investment product by 150 percent and increased their customers’ trust perception.

By improving the user experience, Design Thinking not only has a positive impact on customer relationships, it also adds to the value proposition of the bank’s business model, and can lead to a sustainable source of revenue growth.

If Design Thinking is established as a key component of their strategy, it helps to position the business model of financial services firms by understanding the underlying customer needs and behaviors. Design Thinking enables firms to build out prototypes, test and learn from them, and finally launch the products and services that will help them succeed, the report concluded.

Image via The Center for Innovation in Teaching & Learning (CITL)